Note from Alex: A few weeks ago, I attended my good friend Allen Taylor’s AGM for Endeavor Catalyst, the VC fund he leads. In the presentation he made a passing mention about the changing composition of the Midas List, the annual ranking of the world’s best investors. In this data-driven guest post, he double clicks on VC outperformance, and quantitatively demonstrates where it is coming from today. Spoiler: outside Silicon Valley :-)

King Midas may have lived in ancient Greece, but the Forbes Midas List — the annual ranking of the World's Top 100 Best Venture Capital Investors — has been dominated by US-based investors investing primarily in the United States since its inception in 2001.

That dynamic is shifting. In the latest sign that the venture industry continues to go global, this year’s Midas List — announced by Forbes earlier this summer — is more global than ever before. By my count, nearly 30% of the investors named to this year’s Midas List live and invest outside the United States — from Beijing to Berlin. China’s Neil Shen ranks highest of the non-US investors — coming in at #3 for his investments that include Meituan, Pinduoduo and TikTok parent ByteDance — but this year’s list includes leading investors in Europe, Southeast Asia, Latin America and the Middle East.

Furthermore, the notable deals highlighted — one per investor using Forbes’ methodology — are also more global than ever, including Coupang (South Korea), Flipkart (India) and UiPath (originally from Romania). In fact, the company mentioned more than any other this year — ahead of OpenAI, Coinbase, DoorDash and other Silicon Valley all-stars — is Brazil’s Nubank, responsible for landing six different investors on this year’s list.

The Global Talent of VC

In some ways, this should come as no surprise. The incredible human talent in the venture capital industry has always been global. Vinod Khosla grew up in India. Peter Thiel was born in Germany and raised, in part, in southern Africa. Sequoia’s Michael Moritz is Welsh. Many of the top talents we associate with success in venture have found their way from somewhere in the world to Silicon Valley.

In fact, all five of the top investors on this year’s Midas List were born outside of the United States. Sequoia’s Alfred Lin (#1 on the list) emigrated to the US from Taiwan when he was six years old. Micky Malka (#2) grew up in Venezuela and first moved to Silicon Valley as an adult. China’s Neil Shen (mentioned above) ranks 3rd. The VCs at #4 (Mayfield’s Navin Chaddha) and #5 (Redpoint’s Satish Dharmaraj) were both raised in India, but have made their VC careers investing here in California.

Scanning the full list of the Top 100, the global nature of the talent isn’t always obvious to the reader, given the list presents only the investor’s current “headquarters” location. But for folks like me who have spent decades working on VC in emerging markets, the international roots of these VC all-stars are clear. For example, three of the Top 30 investors — Sequoia’s Roelof Botha (#11), Founder Collective’s David Frankel (#15) and Entrée Capital’s Avi Eyal (#30) — all grew up in South Africa. CRV’s Murat Bicer (#24) is Turkish. So is Felicis founder Aydin Senkut (#88). Kleiner’s Mamoon Hamid (#62) is Pakistani-American, raised mostly in Germany. Other Midas-listers grew up in Romania, Spain, Poland, Iran…the list goes on.

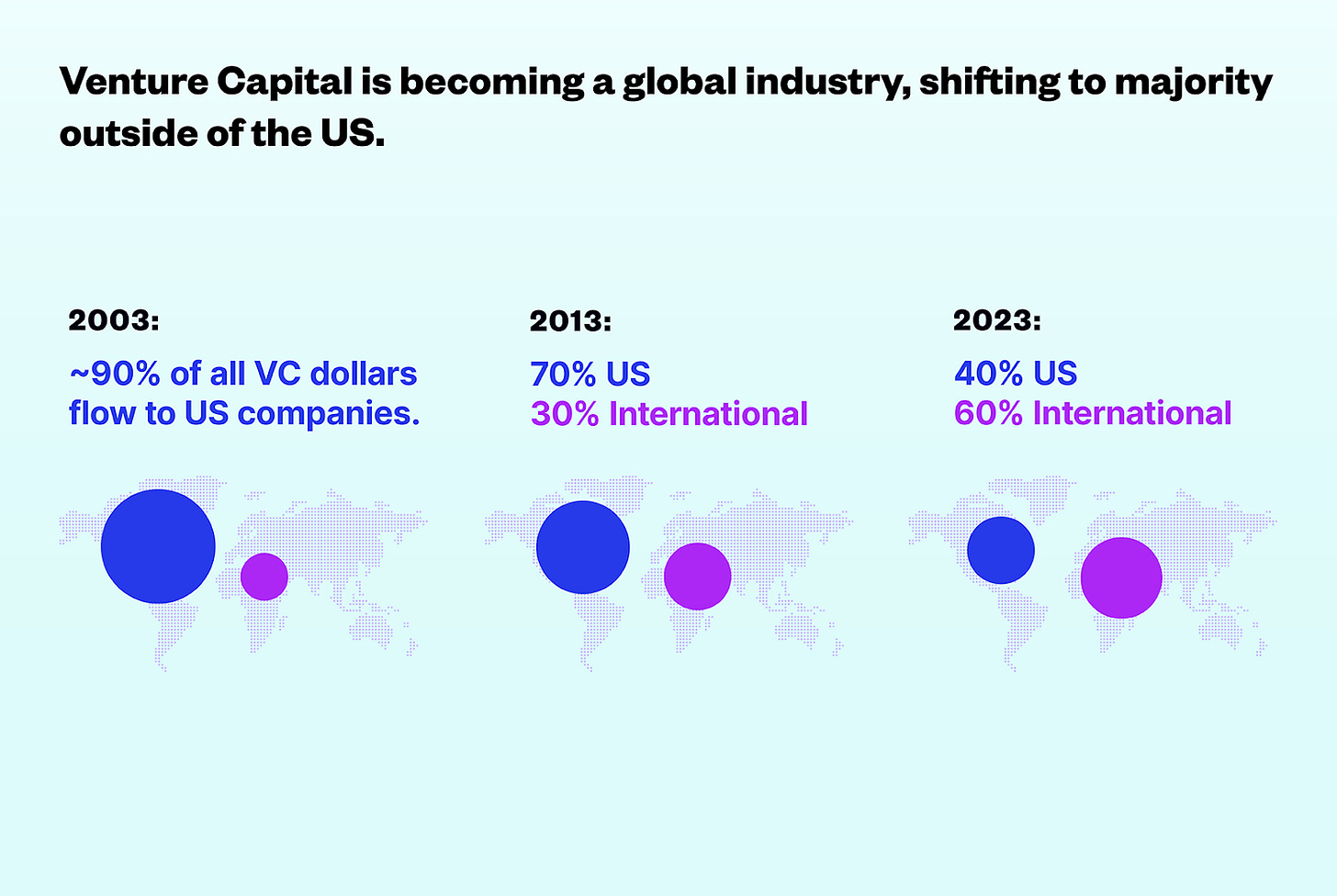

As illustrated in the examples above, historically people moved here to Silicon Valley to earn the chance to invest in the best companies in the world. But this is what I see changing. While the talent is as global as ever before, the investment opportunities — including those that can produce VC’s famous “outlier” success stories — are increasingly everywhere.

Investing Globally: China and Beyond

Nowhere has this been more evident than China, where, over the last two decades, a very large and dynamic VC ecosystem has been built. China accounts for ~17% of this year’s list, with clusters of Midas-listers in Beijing, Shanghai and Hong Kong all focused primarily on the Chinese market.

Perhaps the best example of this phenomenon is Neil Shen, the leader of HongShan (formerly Sequoia China). As a 12-time Midas-lister, Shen’s name is almost synonymous with the rise and success of the VC industry in China over the past decade (he is #3 this year, but has been #1 on the list four times so far), and he has, arguably, the most impressive track record of any venture investor who has built a career investing exclusively outside of the United States.

But others are following. Thanks to success stories like Nubank ($60B+ market cap) in Latin America and Grab ($12B+ market cap) in Southeast Asia, top VCs dedicated to investing in other emerging VC regions — beyond the US and China — are starting to pop up in Forbes’ annual ranking. These investors account for ~10% of this year’s list, with firms headquartered in London, Berlin, Dubai, Singapore, Tel Aviv and even Montevideo, Uruguay.

From Lagging to Leading Indicators

As measured by both where investors are based and where they invest to back the companies that create outsized success, I predict that the Midas List will be more global each year for the next decade, eventually reaching a list where the majority (> 50%) of the investors live and invest outside of the United States by sometime around 2030.

I make this prediction with confidence, because the Midas List is a lagging indicator of the industry’s movement. After all, Midas seeks to showcase the best-performing VCs by analyzing which investors have earned the strongest returns — that is, their portfolio companies have gone public, had an M&A transaction or raised a follow-on round of financing. While Forbes does not disclose the official formula they use, it’s clear in the firms present and the “notable deals” cited that the majority of the ranking is driven by exits — whether IPO or acquisition.

To find a more leading indicator, one need only to look downstream in the private markets to the number of unicorns ($1B+ companies). Reaching unicorn status is no guarantee of a great outcome, and, to be certain, there are more than a few “ZIRPicorns” minted in 2021 that are worth much less than their peak valuation today. But, that doesn’t change the fact that, as Alex Lazarow has covered consistently here in [99% Tech], in 2013, only four cities in the entire world had ever created a unicorn. Today over 150 have accomplished this feat.

Put another way, in 2013, when Aileen Lee first wrote about “unicorns” — coining a new term for a $1B+ VC-backed company— there were only 39 unicorns in the world. All of them were in the United States and nearly 70% were in Silicon Valley. Fast forward to today, and there are more than 1,300 unicorns in the world — with only 51% of them in the United States. 17% of these companies are in China, 6% are in India and a full 26% of the world’s unicorns are in the “rest of the world” — primarily in Europe, Latin America, the Middle East, Africa, and the rest of Asia.

This roughly 50/50 split between US and non-US is the strongest predictor for what the Forbes Midas List might look like just a few years down the line as the world’s best VC returns are increasingly found everywhere around the world.

The Multiplier Effect

To find an even earlier leading indicator, you can look into data on VC dollars invested and even company formation. Here, Endeavor’s research arm — Endeavor Insight — can help provide us with lots of data on how more startups are being created in more countries than ever before.

To take one example, a recent study of the international community of Turkish entrepreneurs and how they can be an asset for Türkiye’s scaling companies, found that successful Turkish founders living in diaspora have a huge role to play in helping lift up the founders building back at home.

At Endeavor, we call this the Multiplier Effect — whereby one generation of successful founders can mentor, support, inspire and invest in the next generation. Much like the famed “PayPal Mafia” of the late 1990s in Silicon Valley, successful companies like Rappi in Latin America and Careem in the Middle East have given rise to more than 100+ companies each in their respective regions.

The Multiplier Effect can also extend to the global talent in Silicon Valley. I’ve been writing for several years about VCs’ increased openness to backing founding teams outside their home city or region, and I continue to observe that it is oftentimes the VCs with international backgrounds who are leading the way.

This makes intuitive sense. For example, when a great global investor like Ribbit Capital’s Micky Malka — originally from Venezuela and #2 on this year’s Midas List — sits in down in an Investment Committee meeting to decide on investing in Nubank in Brazil, Clip in Mexico or Uala in Argentina, he brings a homegrown understanding of these markets, the importance of financial inclusion, and the unique opportunities that a US-native investor might not fully grasp.

A Tale of Two Argentines

For a concrete example of this shift from the VC world’s talent being global to the investment opportunities and returns also going global, let’s look at Argentina, or, to be specific, at the two Argentines on this year’s Midas List: Kaszek co-founder Nico Szekasy (#47) and Emergence Capital partner Santi Subotovsky (#78). (I should also disclose here that both of these investors are Endeavor Entrepreneurs and close friends!).

An entrepreneur turned investor, Santi Subotovsky first moved from Argentina to California for a VC internship in the summer of 2008. I remember our conversations that summer as we talked about how Santi might break into the world of VC leveraging his years of experience building an e-learning company in Latin America. Eventually, Santi networked his way into a role with Emergence Capital, which he joined in 2010, and led Emergence’s early investment in Zoom in 2014. Santi’s appearance on the Midas List for the first time in 2021 marked a classic example of the world’s best talent finding their way to Silicon Valley to ultimately achieve success in venture.

By contrast, Nico Szekasy’s path to the Midas List has touched Silicon Valley several times over the past few decades — including a Stanford MBA early in his career — but he found his “golden touch” investing in markets like Brazil, Mexico, Colombia, Chile and Argentina. Headquartered in South America, Kaszek Ventures, the firm he co-founded in 2011, has now raised over $3B and delivered top tier venture returns to their LPs from several early vintages. His early bet on Nubank in 2013 first landed him on the Midas List in 2021, the same year as Subotovsky. But as Forbes wrote that year in highlighting the first ever appearance of Latin Americans on the list: “Szekasy’s entry to the list demonstrates how much the Latin American venture capital ecosystem has matured.”

In this tale of two Argentines, Subotovsky's story illustrates that Silicon Valley continues to thrive thanks to global talent coming from everywhere, while Szekasy’s tale tells us that, in more and more cases, that same talent can achieve truly global success — and top-tier VC returns — investing in their home region.

We see this arrival of the Latin American VC ecosystem every day in the investment fund I lead called Endeavor Catalyst, where we have invested in more than 300 Endeavor-backed companies — including 58 unicorns — over the past 12 years. Just this year, we’ve made more than a dozen investments in markets like Brazil, Mexico, Colombia and Chile. These investments have been led by homegrown firms like Kaszek, Monashees+, Valor and Astella, as well as international funds like DST, GGV, General Atlantic, Mary Meeker’s BOND, Bicycle Capital, and even Goldman Sachs.

Midas goes home?

The most famous King Midas is popularly remembered in Greek mythology for his ability to turn everything he touched into pure gold. This, of course, came to be called the golden touch, or the Midas touch.

When they first borrowed Midas’ name for the list of top VC investors, I doubt anyone sitting around the editors’ table at Forbes imagined that actual Greeks might one day appear on the list, or that Greek founders and startups might propel international investors to success. After all, the first version of the list from two decades ago was a decidedly US affair.

And yet a new report by Sifted and Endeavor Greece strongly suggests that a new generation of entrepreneurs and investors is building up Greece’s tech ecosystem. This includes Greek founders building abroad, Greek founders building in Greece, and even Greek VCs who might one day join the ranks of the Midas List.

In March of this year, Blueground, a real estate tech company, raised a $45M Series D, putting its valuation in the neighborhood of $1B+. The company is based in the US and founded by a Greek entrepreneur.

In May, European VC Atomico led a $16M Series A investment in HarborLab, marking the London-based firm’s first investment in Greece. Atomico’s Founding Partner Niklas Zennström, who is Swedish and originally co-founded Skype in Estonia, is a past Midas-lister himself and is a big believer that VC success can come from anywhere. He told me during an in-person catch-up in London that he believes the startup success he has witnessed in his native Sweden is more than possible elsewhere.

Like Neil Shen in China and Nico Szekasy in Latin America, Apostolos Apostolakis is an entrepreneur turned investor and an example of world-class VC talent investing at home. He is the Founding Partner of VentureFriends and a seed investor in both Blueground and HarborLab, as well as several other prominent Greek founders and startups. With VentureFriends now investing its third fund, I would be very willing to bet that you will see Apostolakis’ name on a future edition of the Midas list representing Greece!

With 1,000+ startups now thriving locally in Greece — with a combined value of more than $12B+ — it seems that it is only a matter of time before ancient Greek mythology meets modern Greek startup reality. When that happens, Greece will join China, India, Brazil, Argentina, Sweden and others among the ranks of startup ecosystems propelling the next generation of venture capitalists to the rarified air of the Midas List.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)