3 Lessons Ray Dalio - Founder Of The World’s Largest Hedge Fund - Can Teach Us About Global Venture And Startups

The future of innovation is global. We discuss it here.

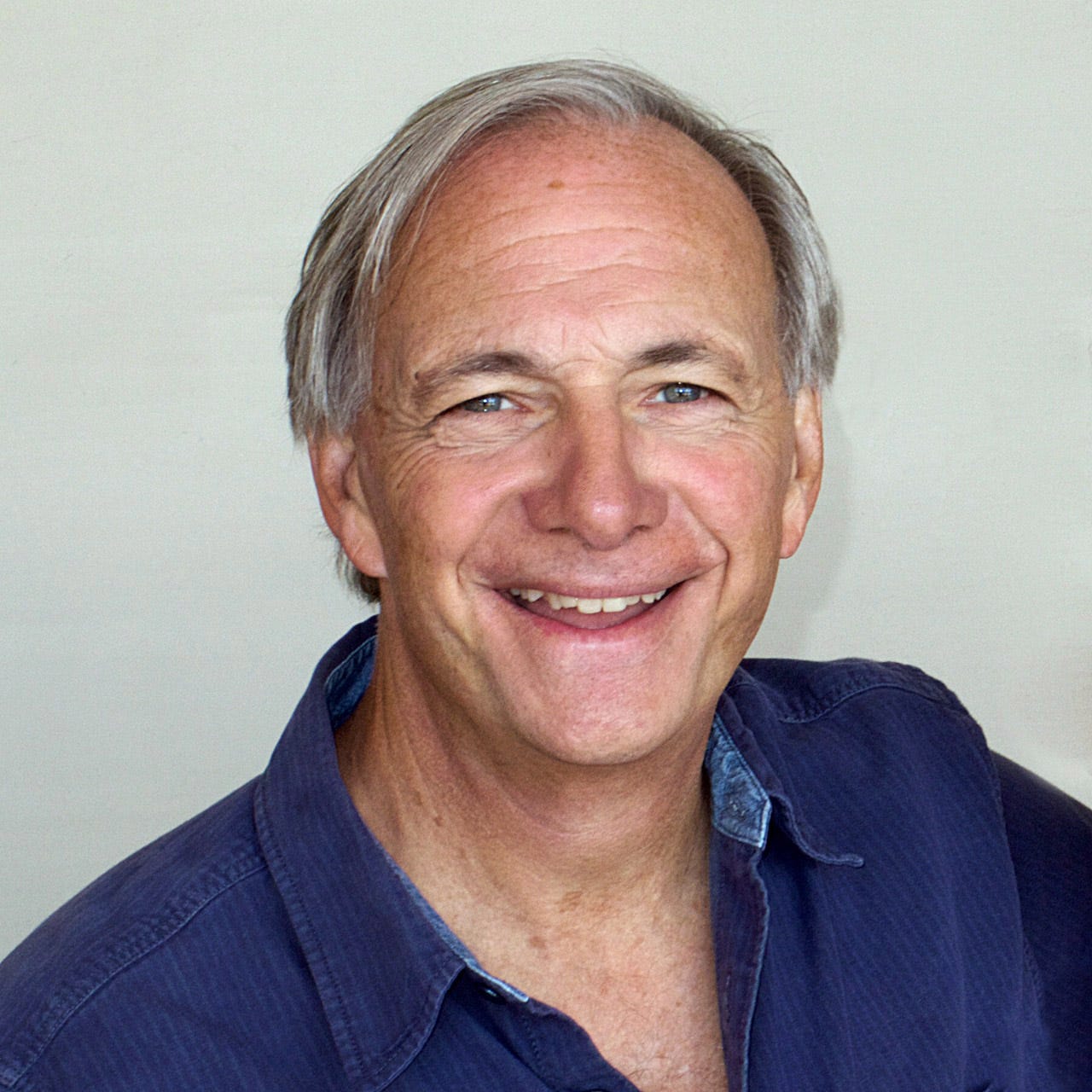

Ray Dalio is the founder of Bridgewater Associates and the author of numerous books, including most recently Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail.

I recently had the opportunity to discuss the implications of his work on the global innovation and fintech landscape. Here are three insights from our conversation.

Changing Role of Reserve Currencies:

Dalio believes that existing reserve currencies, including the US dollar, “will have significantly diminished roles as storeholds of wealth ten years from now.” The balance is shifting against the dollar due to factors like declining demand for dollar debt, increasing transactions denominated in other currencies, and rising geopolitical risks.

This may create unique opportunities in fintech. Of course, what jumps to most people’s minds is crypto, where many argue bitcoin serves as an alternative world currency. Dalio would caution that new forms of money and credit may emerge, but it remains uncertain what will replace the current reserve currencies.

For me, a few other use cases are much more interesting and actionable in the short term. Flexible, real-time, simple cross-border finance may rise in importance as businesses – even those domiciled and selling in only one market – may look to diversify exposure across markets. Treasury needs become even more critical as business complexity rises.

The Power Of Diversification

Dalio emphasizes the importance of diversification in reducing risk and managing uncertainty. Diversification helps to mitigate unknowns and surprises, while concentrated bets on a few correlated assets can be risky.

“I seek to do that in a way that I don’t have either a long or short bias. In this way I have created steadier, more attractive investments that fit together to reduce risks without deducting returns. Said differently, I have found diversification through proper portfolio construction to be invaluable for dealing with unknowns and big surprises and concentrated bets on a few correlated things going up to be very bad.”

In Out-Innovate, I wrote about the role of building the horizontal and vertical stack in startups outside Silicon Valley. The horizontal stack is when founders build a product ecosystem to fill market voids. The vertical stack arises when founders need to create enabling infrastructure for their businesses. Both of which help emerging market startups build diversification in their revenue streams and manage risk in uncertain ecosystems.

Uncertain new opportunities

Dalio highlights five major forces that will shape our future. “They are 1) the unsustainable level of government debt growth, 2) the great internal conflicts over wealth and values differences that are causing high levels of populism of the right and the left that threatens to cause bad international conflict that will be a type of civil war, 3) the international great power conflicts most importantly between the United States and China that is in the brink of some type of international war, 4) disruptive acts of nature in the form of droughts, floods and/or pandemics, and 5) technology changes, most importantly AI related and its consequences.”

To me, one of the macro trends that powers resiliency, local wealth creation and counters populism is the rise in entrepreneurship. This manifests itself in various forms, be it the creator economy, the gig economy or the general aspiration to become entrepreneurs present in younger generations. As another Forbes article wrote, 48% of Gen-Zers have numerous side hustles and 62% indicate they have started, or intend to start, their own business.

This is also an opportunity for fintechs in powering small businesses and new business creation. For example, my former portfolio company ZenBusiness serves as a single pane of glass for services businesses, in the same way Shopify has powered ecommerce. A range of horizontal platforms are emerging to power this shift.

Bonus: The Importance Of Culture

Dalio stresses the importance of culture in building a company or investment firm. “If I had a VC fund rather than a hedge fund I’d keep the exact same culture as I had at Bridgewater…In a nutshell, it involves having meaningful work and meaningful relationships through radical truthfulness and radical transparency.”

For Dalio, this means fostering a culture of tough love: “being tough on each other to hold each other to high standards of excellence while caring deeply about each other makes for top performers committed to the mission and I believe that radical truthfulness and radical transparency to find out what is true and figure out what to do about it is a practical way of having excellent decision making.”

To build a startup or generate long-term venture capital returns is no easy feat. It requires improving every day to generate long-term outcomes. Culture is a big part of this. Bridgewater’s culture is unique and authentic to Ray’s leadership style. Founders should find an approach that works for them, aligns incentives, allows people’s voices to be heard and helps everyone be the best they can be every day.

Parting Thoughts

Ray Dalio is not just one of the world’s greatest investors. He is a founder of one of the most storied investment firms, and today a prolific author and counselor on macroeconomics. We hope these insights will be helpful in your own journeys building your firm.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)