3 predictions for the future of buy-now-pay-later

What you can learn from taking a global perspective on innovation

This piece was first published in my Forbes column here: https://www.forbes.com/sites/alexlazarow/2021/08/30/amazon--affirms-bnpl-deal-and-three-predictions-about-what-it-means-for-fintech/

It has been a big few months for the “Buy Now Pay Later” space.

Amazon just announced a partnership with Affirm to allow certain customers to check out with the latter’s product, and split up the cost for purchases over installments. Japan’s Paidy was acquired by Paypal for $2.7b. Earlier this month, Square announced its $29b acquisition of Afterpay.

Of course, installment loans are not new. But what Affirm, Afterpay and the broader Buy Now Pay Later (“BNPL”) space have done is make it an incredibly simple, customer friendly transaction in the digital world.

This is becoming a big space. McKinsey estimates that fintechs have already diverted $8-10b in annual recurring revenues, largely from incumbents, with this new approach. In this piece, I want to explore first why BNPL is a win-win-win product which has made it quite popular, and offer three predictions about what it means for fintech.

Win-Win-Win

BNPL models are unique in that they benefit multiple parties all at once.

Customers benefit from a clear, simple and transparent check-out process and loan product. They also offer payment flexibility. One of the key challenges for many customers in the US and around the world is not necessarily a lack of capital, but liquidity crunches – not having the capital at the right time. Installment loans allow customers to manage this, and also pay something back over the course of their enjoyment period. (Of course, too much of a good thing can be bad, and making it too easy to get a loan or over leverage must be monitored).

BNPL providers are happy because it offers a unique customer segment at an attractive cost of acquisition (since the acquisition is done by the merchant).

Crucially, BNPL benefits the merchant too. BNPL is credited with ecommerce conversion improvement, lowering cart abandonment and, given the longer term relationship in some cases, a higher LTV (e.g. McKinsey estimates that BNPL customers have nearly 50% higher engagement in comparison to a private label card). They may also generate new customers – those who are looking for a specific good and a financing option.

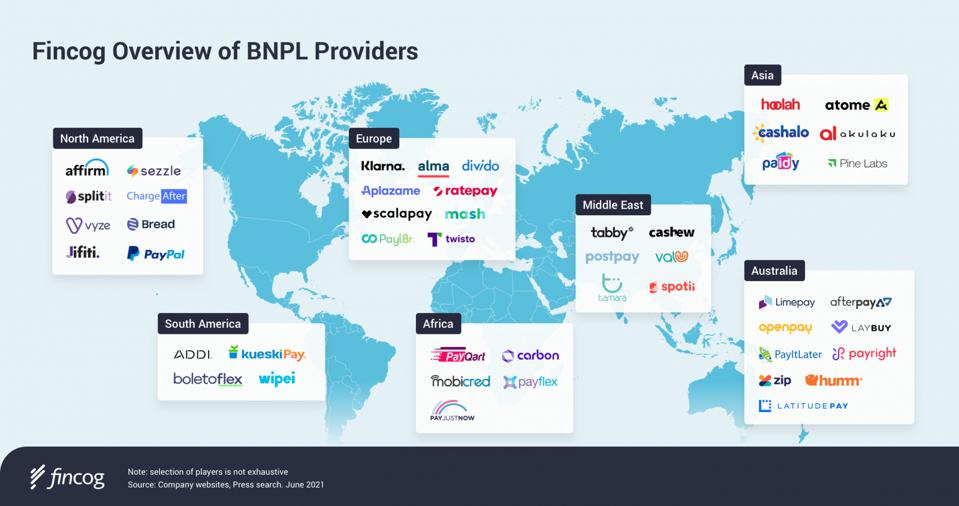

That’s why the movement is scaling globally.

I predict BNPL players will have important impacts on financial services going forward if executed properly.

Prediction 1: BNPL serves as an onboarding tool for the underbanked

BNPL in the US disrupts existing and abundant sources of credit. In developing markets, BNPLs look much more like Creators, offering a de novo check out option and financing alternative for its customers.

That’s because for most of the world, credit availability is not the norm. Over 1.7 billion people are unbanked (and nearly the same amount are underbanked). By using alternative data for underwriting coupled with lower cost delivery models, BNPL platforms can expand the pool of capital. This spans players like FinAccel in South East Asia (a portfolio company), to Addi in Colombia and Kueski in Mexico (also a portfolio company), to Zest in India. The BNPL product is often targeting the underbanked.

In many emerging markets ecommerce penetration remains very low. In Latin America, it is under 5%. For many users, one of the key barriers to transacting digitally is a digital means of payment. BNPLs offer one such ramp into the digital ecosystems.

Prediction 2: BNPL will create surprising network effects

Perhaps the biggest long-term potential of a BNPL at scale are its broader network effects. By building a customer relationship and expanding their footprint, BNPL players can centralize the customer purchase experience in one place. This customer relationship can be parlayed into a broader set of financial product offerings (e.g. larger loans, product warranties, insurance, etc.). Perhaps the bigger opportunity is that because the transaction is happening outside of the card networks, BNPLs are creating an alternate set of transaction rails.

This is of course powerful in the West where card payments are expensive. But it can be transformative in markets where card penetration is non-existent (never mind the cost of transaction when customers don’t have cards to use). That’s why I believe we’ll see players in more nascent startup ecosystems with BNPL offerings evolve into super apps much more quickly.

Prediction 3: BNPL loan structure will be integrated elsewhere

I have long written about the rise of embedding financial products and services. I expect we’ll start to see this product embedded.

For Amazon, that will mean doing it in partnership with a player like Affirm here in the US. In other markets, like for Mercado Libre in Latam, it will mean developing its own Mercado Credito and embedding it within their offering.

I also expect it to be built into to credit cards as a feature. Already, Amex and other cards have started offering the ability to its customers to create installment plans for specific purchases within their portal.

There is some irony to this evolution. Cards offered payments solutions and then a free month of financing before expensive interest rates set in for balance payments. BNPL disrupted that with friendlier and cheaper terms. Now credit cards are doing the same.

Where we go from here

One thing is for certain. BNPL is becoming a bigger category. BNPL providers enjoy a clear distribution advantage and data advantage, and if executed properly a unique ability to delight their customers. That’s one of the reasons they will be well positioned to grow their customer relationships over time in markets where there are less alternatives, notably in developing markets.

I expect we’ll see more of these types of partnerships in the years to come, not just in the West but around the world. What do you think?

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)