American metamorphosis, global ecosystems, remote work

The future of innovation is global. We cover it here.

Metamorphosis

Big thank you to the team at American Metamorphosis, the podcast from Atlantic Re:think & BCG for having me in their latest episode.

“Today, we face vast crises in a number of arenas, from housing to health care, agriculture to AI. They are simultaneous and intersecting: A housing solution may exacerbate climate change, which threatens our food systems; an AI development could put workers at risk and lead to even higher inflation. Across sectors, it’s clear that novel solutions are needed to address urgent problems.

Only truly innovative ideas will drive sustainable progress—and embracing those ideas means embracing risk and short-term uncertainty. As we consider where and how to advance next, we reflect on our past; on moments where hope and history rhymed, and ask ourselves what we are willing to risk to move forward.”

In the piece, among other topics, we discuss the lessons that Silicon Valley and the world of innovation can learn from Detroit - which once was the global capital of innovation for a different technology - cars - and in a different age. We also dive into the importance of taking risks, but also managing them when building startups. ‘Move fast and break things’ just doesn’t work when you’re building innovation that matters - like in financial services, healthcare or education.

Give it a listen here:

Remote work discussion

Last month’s remote work section spurred some discussion about how we will manage return to work practically in a new globally distributed workforce.

For starters, how does in-office hybrid work, in reality? “Executives usually cite collaboration and work culture as reasons to return. But once in the office, workers are finding that Zoom meetings are still a central aspect of the day. Even for those back in the office, it can be easier than corralling a group into a conference room, and in some cases, it’s a necessity for teams working across different cities or countries. For those who prefer working from home, but are now required to come into the office, it’s also a source of frustration.”

How will employees work together?

And how do we create infrastructure in the world’s most emerging ecosystems? On this, inspiring story from the border of Zimbabwe where data costs make remote work unaffordable. “For people living near the border with Mozambique, there is a workaround. Enterprising traders cross over on foot or on motorbikes, bulk-buy Movitel SIM cards, and return to Chimanimani, where they distribute the SIMs to supermarkets and corner shops, where they are sold with a markup of more than 50%. The availability of affordable internet has made the unfashionable rural district into an attractive destination for people who need to be online for work. The area was hit by a tropical cyclone in 2019, which displaced more than 11,000 people in Chimanimani alone, bringing hundreds of NGO and health workers to the area to work on the relief. Many have stayed, taking advantage of the cheap internet access to work remotely.”

Interesting discussions

The unprecedented rise in venture capital funding in many startup ecosystems is having unintended consequences. One of which is a rise in M&A. “That amount of VC money comes with expectations, and investors are impatient. They either want the companies they invest in to grow into regional market leaders, or they want to cash out, which tends to mean an exit via a sale to the market leader.”

Speaking of emerging ecosystems, [not] breaking news: Kenya is “becoming a global hub of fintech innovation”. The piece provides a good summary of the evolution of fintech and its role in emerging markets. “Now, though, the center of FinTech innovation seems to be shifting again, this time to Africa. United by mobile phone proliferation, and often in the absence of internet-capable phones, this wave is defined by its inclusive mobile banking services…the African FinTech wave is being built on mobile phones, whose adoption in the continent accelerated around the turn of the millennium and are now pervasive.”

You’re traveling and looking for that app. But what is it called? Helpful guide to everything from Jumia (pronounced joo·me·ah) to Byju (bye-joos).

Climate change is upending the world of financial services. Fintech is coming to help fill the void - my latest piece on Forbes.

New technologies like AI are giving us new tools to fight climate change. “Some researchers have taken artificial intelligence—a technology often considered an existential threat in its own right–and tried to turn it into a vehicle for climate action… It could generate emergency action very different from the profit-driven, bias-amplifying and misinformation-spreading algorithmic regime we are familiar with. Giving much larger play to input from the field, from networks of engaged participants, this ‘climate AI’ could be a game changer in the tech ecosystem, as in the physical ecosystems now facing their worst risks.”

Regulation has an important role to play to manage bad actors in financial services. For instance, “The Consumer Financial Protection Bureau is suing TransUnion and one of the credit reporting giant's longtime executives for allegedly continuing to employ deceptive sales and marketing tactics…Specifically, TransUnion used ‘dark patterns’ — or hidden tricks — to get people to inadvertently click links to buy subscriptions, products or services, which are then difficult to cancel, the suit contends.” Paradoxically, this will be an opportunity for consumer friendly, tech-forward players to build stronger trusting relationships with customers.

I’m a big believer in the power of social commerce to bridge the digital divide. It can also drive financial inclusion by offering products like insurance and managing adverse selection. Great piece on social commerce’s role in South East Asia. “Social commerce doesn’t silo our retail experiences from the rest of our lives; rather it leverages the power of community and connection to create opportunities in everyday life through social networks…Southeast Asians have a strong desire to belong in a community, and finding strong relationships is more important to them than their global counterparts… The social commerce model leverages community leaders and influencers’ connections to generate sales by marketing directly to their friends and family.”

Are we in a tech bubble? We’ve been saying so for a decade. “The message since has carried those scars: The boom times are ending. Buckle in for a rough ride. Yet every time, more money has flooded into start-ups. Instead of a collapse, things got bubblier…Today’s warnings are different from those of the last decade. Investors tiptoe around the word ‘bubble,’ referring instead to a ‘recalibration,’ a ‘pullback’ or even a gentle “softening.” The people who once called for caution grew tired of being wrong, and their audiences became numb to the warnings. Every time the alarm bells rang, more money poured into start-ups…Even as the biggest factor driving investors to high-growth start-ups over the last decade — low interest rates — begin to change, even as economists worry about an impending recession and even as start-ups lower their valuations or suddenly run out of cash, few today are predicting a total collapse. A decade of talking about a bubble that never burst will do that.”

And yet…

Book of the month

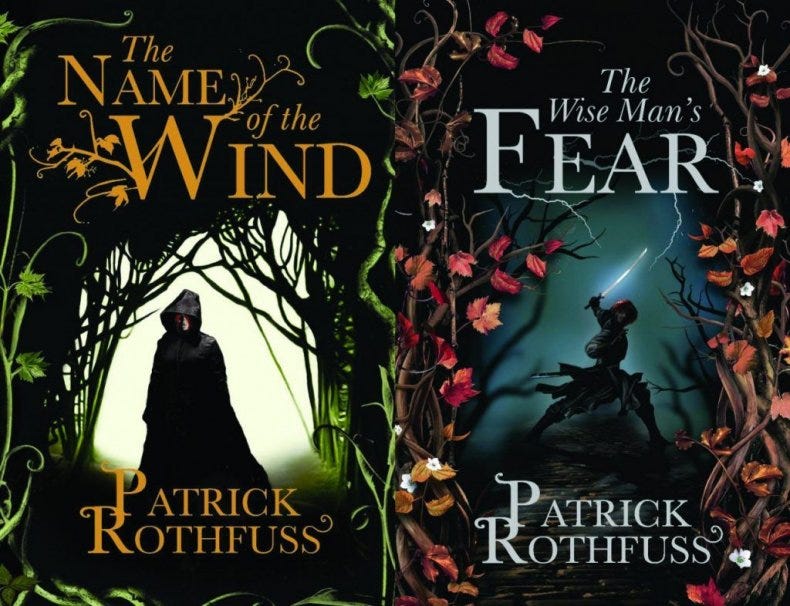

This month, my wife and I welcomed a son, our second kiddo. And in the sleepless nights, I’ve indulged in some fiction. Very much enjoying The Kingkiller Chronicle.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)