As VC Winter Comes to a Close, Investors are Deploying Again

Guest Post by Fernando Fabre, CEO of Kauffman Fellows

In this episode of 99%Tech, I’m delighted to welcome a guest post by Fernando Fabre, the CEO of Kauffman Fellows CEO. Every year Kauffman puts out a fabulous piece on venture capital sentiments. Are VCs optimistic about the future or pessimistic? Are they deploying or holding back? How is this in the developed ecosystems vs frontier ones? And what about when A.I. is not in the headline of your pitch? Well, Kauffman Fellows has a pretty good barometer: there are over 900 global fellows around the world (including yours truly) that they survey every year.

Guest post:

Good news for the venture capital industry: The venture capital winter seems to be over, and VCs from the Kauffman Fellows network are deploying capital. Drawing from a comprehensive survey of 262 venture capital fund managers who oversee $250 billion in AUM, we've gathered the insights from fund managers from the most successful and global venture firms, including Canaan, Creandum, Intel Capital, Kindred Capital, Sozo, Tribe Capital, Ulu Ventures, and more.

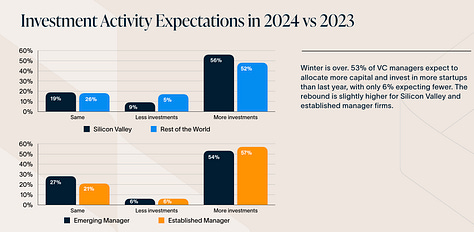

Good news for entrepreneurs aiming to change the world: get those dusty decks out of the drawer. The clearest shift in expectations among VCs is that for 2024, more than half of venture firms surveyed expect to make significantly more investments than 2023, which was the lowest on record for a while. One caveat: Investors are considerably more focused this year on retention and value metrics.

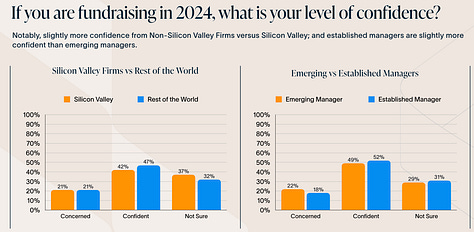

For venture fund managers (general partners), the landscape is still gray for those aiming to raise fresh capital from LPs. While most Kauffman Fellow managers are confident that they will hit their LP fundraising targets; 20% of them are concerned they won't, and 30% are not sure what to expect yet. Overall, 97% of them agree that 2024 is still a challenging year to raise new venture funds.

This uncertainty is largely led by a clear expectation that institutional investors will reduce their exposure to the asset class. A majority of managers believe that endowments and foundations will reduce allocations in the form of new fund commitments (meaning they may still do recaps). The good news could come in the form of sovereign funds willing to fit this gap, and from family offices willing to step up their indirect allocations.

We anticipate that for the rest of 2024, established fund managers will knock more often on the doors of sovereign funds while emerging managers will scramble to tap into the network of family offices.

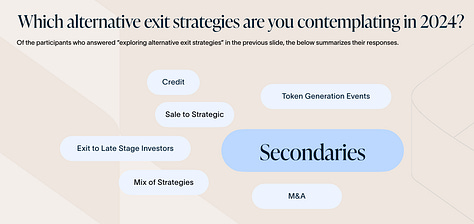

For LPs expecting liquidity this year, things look bleak but with chance for sun. A third of managers don’t expect liquidity events, while 40% are aiming to tag along the acquisition market (through M&As). The sliver of good news is that LPs could see liquidity sooner if the IPO channel heats up (the survey was completed before Reddit’s IPO). To that end, Silicon Valley-based funds, as well as established managers in general, have a slightly better expectation that their portfolio companies could IPO this year (7% vs 3% for the rest of the world). If Silicon Valley leads a jumpstart in the IPO market, we expect the same to apply elsewhere.

As Gale Wilkinson, Founder & Managing Partner at VITALIZE Venture Capital says

“We anticipate funding activity to continue to increase this year, and while M&A will likely remain soft through year-end, we think exit activity will begin to rebound in early 2025.

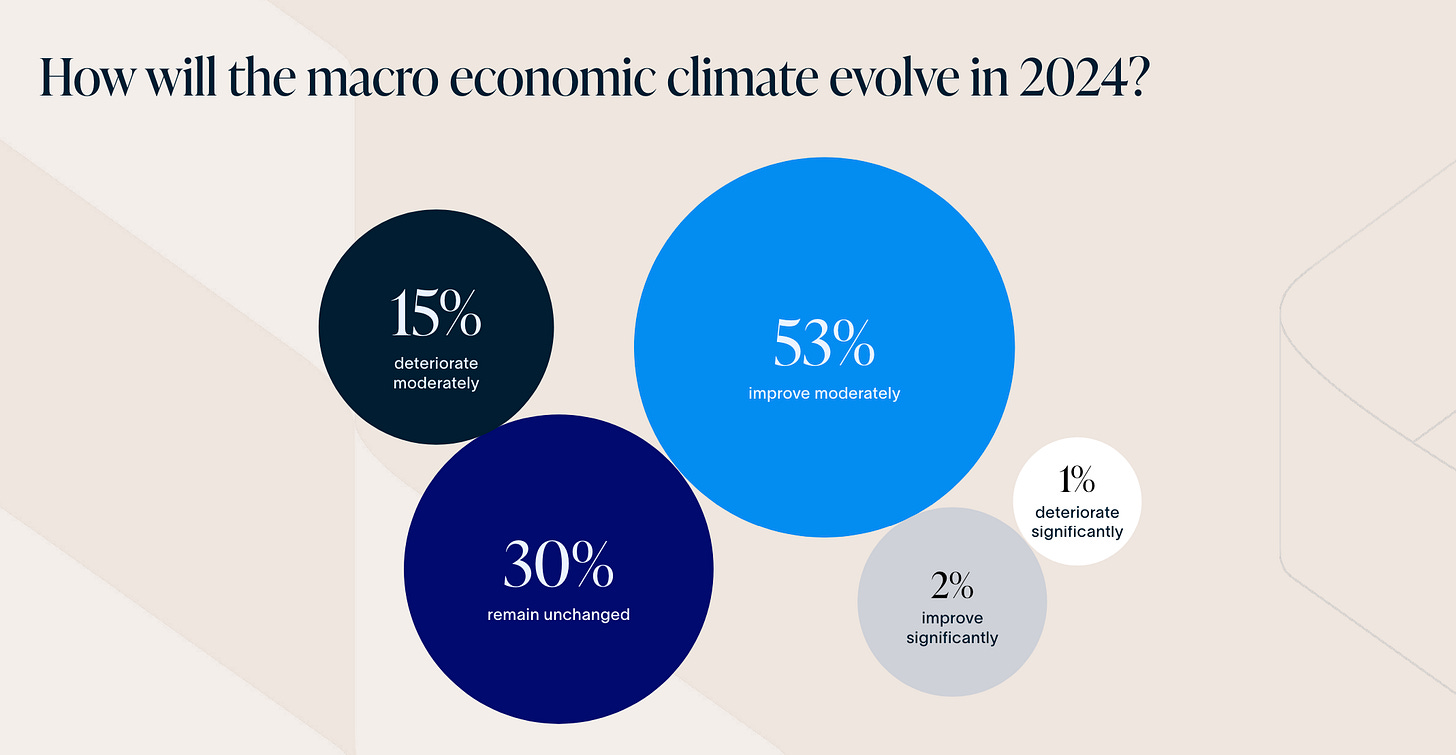

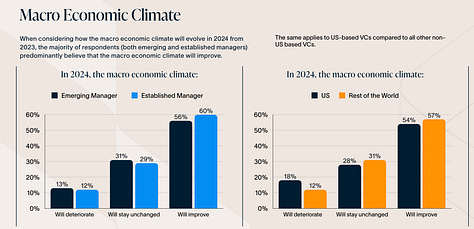

Last, the new year seems to indicate that we have hit the lower end of the VC down-curve. The majority of VC managers believe that the macroeconomic environment will improve this year. As Fredrik Cassel, General Partner at Creandum (KF Class 12), notes in the report, “2024 is the year of truth in VC.”

Cassel continues, “The market is currently witnessing a positive trend in terms of both velocity and investor interest. However, this enthusiasm is notably more focused on specific segments and business models. Businesses involved in AI, climate, and generally any software ventures that demonstrate efficient growth are experiencing high demand. Conversely, businesses with lower margins, those requiring substantial capital investment, and consumer companies are navigating a challenging landscape.

He continues, “Over the previous two years, numerous companies have been extending their runway; a significant portion of these will need to approach the market for fundraising within this year. Within AI and while we expect demand and funding tailwinds to continue, we also expect businesses and investors to apply increasing scrutiny on retention and value.”

Overall, we hope this report serves as a roadmap for navigating the venture capital landscape in 2024. Whether you're a founder with a vision, a GP navigating the fundraising maze, or an LP looking for clarity in uncertain times, there's something in this report for you.

A few highlights of the report

About Kauffman Fellows

Kauffman Fellows is a global network that gathers the best venture capitalists in the world. Through our two-year education program and our vetted peer-to-peer network, Kauffman Fellows has accelerated the careers and the venture capital firms of hundreds of professionals in the field. Since 1995, our network has grown to 882 Fellows (86% of them General Partners or Managing Partners/Directors) from 765 VC firms who collectively manage over one trillion dollars. These Fellows and their teams have invested in over 90 thousand entrepreneurs and harvested over 27 thousand exits.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)