Second order lessons from Brex's acquisition

The future of innovation is global. We discuss it here

This piece was first published on my Forbes column here.

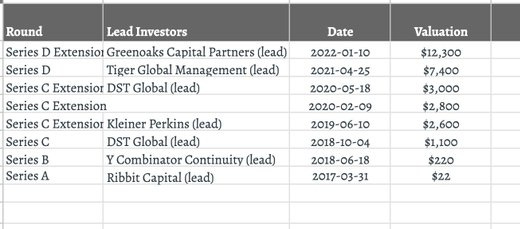

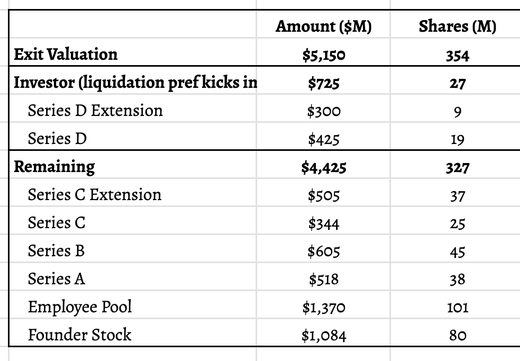

Capital One announced that it’s acquiring Brex, the corporate card and spend management platform founded in 2017 by Brazilian entrepreneurs Henrique Dubugras and Pedro Franceschi. The deal reportedly values Brex at just over $5 billion. This is both a massive fintech outcome, and a significant step down from its $12 billion peak valuation in 2022.

Brex was a pioneer of corporate cards & spend management for startups, serving companies that traditional banks wouldn’t touch, and grew to power expense management for thousands of businesses.

A lot of ink has been spilled on the economics of the deal, who made money - sounds like employees were made whole and early investors did great, while later stage investors get their money back, which is good for this vintage deal.

This is not the focus of this piece. We will dive into three non-obvious second order lessons from Brex’s acquisition.

1. Geographic Arbitrage Creates Categories, Not Just Companies

When I wrote my debut book Out-Innovate with HBR in 2018-2019, I interviewed the Brex founders, who were incidentally incubated by Andre Street the cofounder of Stone, a Brazilian fintech unicorn.

What struck me at the time, was the role of cross-pollination of ideas across geographies. The Brazilian founders, Henrique Dubugras and Pedro Franceschi, saw an opening that American bankers missed because they understood how different customer segments required entirely different underwriting models.

They did not copy a model from one market to another, but brought an outsider’s perspective to identify gaps incumbents can’t see, and combined it with global experience.

Ultimately, Brazilians building a U.S. technology company, catalyzed a global category.

At Fluent, we see this pattern repeating across our portfolio. Certain models – particularly with local network effects in regulated industries (notably fintech) create waves around the world. Companies like Float (Canada), Pleo (Europe), Jeeves & Clara (Latam), Conta Simple and Kamino (Brazil), Razorpay (India) or Aspire (South East Asia). Note, I am an investor in Clara and Kamino.

There are many examples of successful immigrant founders bringing global know-how to win in the US.

2. Finding The Right Wedge Is A Secret Weapon

Brex used corporate cards to get in the door, then cross-sold treasury, bill pay, and expense management. The card was the hook. Ultimately, the broader platform was the business.

Some have argued convincingly this was where most of the value accrued.

Ramp is executing a similar playbook and scaling rapidly with an ever-growing (and self-reinforcing) product suite. Corporate cards get them in the door, but from there, they can flock everything from bank accounts, treasury management, bill payment, etc.

Mercury is executing a similar playbook, albeit, starting from a different place. Mercury started as a modern SMB neobank, and now expanding to overlapping products.

Rippling would call this the compound start-up. Finding a solid wedge, and adding other products together – where the whole is greater than the sum of its parts.

The wedge often has most value when it is a hair-on-fire problem (getting credit cards for unbankable startups qualifies). Bonus points if they are high-frequency, painful transactions, that keep the customer coming back. Corporate cards have one additional bonus – they are high up the decision making stack (often the CEO sets it up at founding), and touches multiple departments over time.

3. Timing the Wave Matters More Than We Admit

Brex launched in 2017 when fintech funding was accelerating. They raised their big rounds in 2021-2022 at peak valuations during the boom. While they are exiting in 2026 as the market normalizes, they caught most of the fintech wave and the best of the covid days (amassing a low-cost war chest).

Founders who started 2-3 years later (2020-2021) are now facing a much harder path: higher customer acquisition costs, more skeptical investors, mature competitors, and a tighter funding environment. Building a comparable war chest at an early stage would be comparatively rare today.

Yes, Brex is selling past the fintech peak. But they benefited from it too. Ultimately, being early to a good wave can be just as valuable as riding the peak.

While it is interesting to debate whether this was a good deal and for whom, ultimately, Brex is a company that inspired a global category, during a defining fintech wave, and expanded to build a true platform. Congrats to the team!

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)

Wow, that bit about diving into second order lessons is super smart, because while the initial financial outcomes are interesting, the actual systemic changes are where the real learnin happens for everyone, not just the early investors.