Startup efficiency, and more money than God

The future of innovation is global. We discuss it here.

Measuring startups by their efficiency

When I wrote Out-Innovate, I described Camel startups based on their inputs: startups built on a foundation of sustainable unit economics, that manage cash burn and think about the long-term.

Another way to think about Camels is based on their outputs. When they’ve grown, how efficient have they been to scale?

In that vein, loved this analysis of valuation / capital raised as a way to look at camel efficiency.

If you’re not a camel, and depend on venture capital, you are much more susceptible to the vagaries of the market and macroeconomic conditions.

So what is happening in today’s venture environment?

Excellent analysis: “If public comps apply to private companies, then the market should expect a ~70% reduction in private valuations. Venture capitalists have continued to invest at similar prices & similar round sizes in the most sought after companies. But round volumes have fallen by at least 20% & likely much more. $220b in dry powder (dollars VCs have raised but not yet invested) will buoy valuations higher than expected…Publics are down 70%. Private data suggests a steady market but it’s a mirage. I think the market will settle in Q3/Q4 at a 40-60% decline to Q1 2022 & volumes will increase again in early 2023.” Full presentation here.

Many of my readers pinged for more camel-themed videos. So here is another one, taken out of its original context, themed: how non-camels react to volatile times:

The good news: in many emerging ecosystems, camels are cash flow positive (ie. default alive, without venture capital required) much earlier in their journeys. As a result, if and when they do take venture capital, it is to fund much more efficient growth, not as a requirement.

Is better faster and cheaper always in fact better or cheaper in fintech?

After a decade of digital payments adoption, are we seeing a renaissance of… cash? Commenting on cash withdrawals: “Britain’s Post Office, which operates a host of ATM branches in the country, said [it] is up ~8% MoM and ~20% YoY. Digital payments offer many advantages over traditional cash payments - increased speed and convenience at payment sites, offers and discounts from various card providers and ability to pay in different currencies, to name a few…some people have cited the very convenience of swiping a card or tapping a phone to pay as a problem when they are trying to control spending. Plans like the ‘30 day cash challenge’ have as a result emerged to try and help people control spending.” The very advantage of digital payments in this case can also be its drawback.

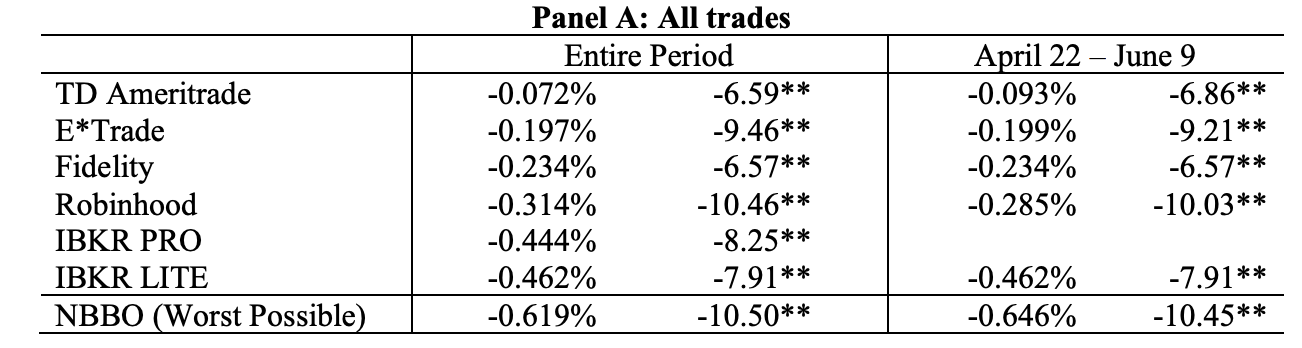

Fascinating research on the cost of conducting a $100 trade on various digital platforms. Newer ‘free’ platforms were not necessarily cheaper. TD Ameritrade and E*trade both trounced Robinhood in this analysis.

My take: the trend line of fintech digital adoption: more transparency and fairer prices creates an enduring advantage.

So what is the trend line? While Covid was a massive accelerant and in many ways an aberration, things are coming back to the trend line. And its direction remains clear: up and to the right. Exploring U.S. fintech: “downloads and new accounts have declined year over year during recent months. Certain companies may be struggling, but as we look beyond the idiosyncrasies of the last two years, the longer-term sector trend remains favorable. Download growth on a three-year CAGR basis (compounded growth since before the pandemic) remains between 15-20% and appears to have returned to the pre-Covid trend line.”

Interesting discussions

Last month we discussed ESG and many of the challenges it was facing. In that vein, resonated with Obvious' Ventures’ approach to early stage ESG and impact measurement. “During that journey, we’ve seen increasing excitement and acceptance of Environmental, Social, and Governance (ESG) practices in investing, with the meaning behind those three letters changing substantially across investment stages. In public markets, ESG factors are used for risk analysis and reporting, as well as a filtering mechanism for building mutual funds and exchange-traded funds (ETFs). In growth equity, meaningful ESG measurement is occurring around late-stage companies that have measurable areas such as greenhouse gas emissions and diversity metrics across their lines of business. In contrast, ESG for early stage venture capital is largely undefined, with the language of Venture ESG still being written.”

What is the metaverse? “The metaphors we use to describe new technology constrain how we think about it, and, like an out-of-date map, often lead us astray. So it is with the metaverse. Some people seem to think of it as a kind of real estate, complete with land grabs and the attempt to bring traffic to whatever bit of virtual property they’ve created…But what if, instead of thinking of the metaverse as a set of interconnected virtual places, we think of it as a communications medium? Using this metaphor, we see the metaverse as a continuation of a line that passes through messaging and email to “rendezvous”-type social apps... This is a progression from text to images to video, and from store-and-forward networks to real time…but in each case, the interactions are not place based but happening in the ether between two or more connected people.”

A common narrative is that the downturn will affect emerging markets more directly. Yet new research is showing positive signals to the contrary. “We’ve speculated…the global economic slowdown could cause Western investors to shy away from the African continent’s booming tech sectors and, instead, focus on challenges closer to home. But a report published last month, which examines key elements of African tech ecosystems, suggests that while the extraordinary growth of venture investment over the last five years has been a great narrative, it isn’t the most important story — which is in the still untapped potential of the continent’s digital economy.”

Do algorithms feed us what we want? Or do they shape our desires subconsciously? What are their effects on our health, self-perception and anxiety? Fabulous long-form discussion exploring this critical question. “An algorithm, in mathematics, is simply a set of steps used to perform a calculation, whether it’s the formula for the area of a triangle or the lines of a complex proof. But when we talk about algorithms online we’re usually referring to what developers call “recommender systems,” which have been employed since the advent of personal computing to help users index and sort floods of digital content…Users can’t be blamed for misunderstanding the limits of algorithms, because tech companies have gone out of their way to keep their systems opaque, both to manage user behavior and to prevent trade secrets from being leaked to competitors or co-opted by bots.” Worth reading to the end.

In my most recent 99%tech column we dove into the power of regulation to shape innovation. The case study was fintech and the role of the Durbin Amendment in the U.S. This week we had another major new law that should have game-changing effects. California will ban the sale of gasoline cars after 2035. Since California is a standard setter, its rules will influence regulation beyond. And given the market is so large, it should further drive innovation and investment into EVs.

Speaking of technology trend lines: fintech is not the only thing reverting to the mean. All technology adoption is reverting back. “Back in 2020, as we were all locked down and forced to do everything online, we got very excited about ecommerce penetration. All sorts of charts went viral showing that we’d jumped forward anything from three to five years in a couple of months. This was a big part of the ‘Covid Rotation’, and now we’re on the other side of that rotation - people went back to the office, and back to stores, and back on planes. And for retail and ecommerce, it looks like a lot of that growth was temporary, and we’re reverting to the trend line.”

How should you measure the value reduction in your startup? “NASDAQ is down 30% YTD. The looming recession is having an impact on venture capital for a whole host of reasons…Your startup is worth less than it was in January. But how much less? One of the simplest ways to understand how much value your company has lost is through the use of metrics.”

Embedded insurance has the potential to drive fintech penetration. Why? It benefits from the 3 Ds: a distribution advantage, a data advantage and a delivery advantage. Fun round-up (where my research is featured) on emerging trends. “Embedded insurance continues to spread and grow. Its popularity stems from its ability to provide benefits to carriers, agents, third party businesses and customers — all in the same transaction. As technology makes it easier to offer embedded and point of sale coverage, it’s likely that customers will soon be able to access insurance for every need at the moment that need arises. What does a world of embedded insurance look like?”

In this digital age, ever wonder how a physical book was printed? I did. Great piece that walks through step by step.

Fun personal updates

Excited to keynote the One Region annual luncheon in Indiana in October. Check it out here.

Leadership lesson of the month: fun to be featured in the University of Pittsburgh’s leadership calendar:

Book of the month

A few months ago I read Sebastian Mallaby’s The Power Law (which I recommended here). This month, taking another leaf out of his writing, I read: More Money Than God: Hedge Funds and the Making of a New Elite.

As the NY Times reviews it: “This is not an obvious time to be glorifying financial tycoons. Making enough money to buy your own private island might have earned you an airbrushed magazine cover a decade ago…Today’s populist mood has not deterred Sebastian Mallaby. In ‘More Money Than God,’ his smart history of the hedge fund business, Mallaby does more than explain how finance’s richest moguls made their loot. He argues that the obsessive, charismatic oddballs of the hedge fund world are Wall Street’s future — and possibly its salvation. Mallaby’s contrarian argument is sure to delight his subjects, and not only because he is so openly on their side. As he shows in more than a dozen interlocking stories, the history of hedge funds is a history of the men who were able to spot market opportunities others missed, and who were prepared to gamble a fortune on their convictions.”

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)