Temu's Q3 results and cross-pollination, down rounds, American Gun

The future of innovation is global. We discuss it here.

Cross-pollination in action: Chinese ecommerce in the US

One of the biggest trends in technology is cross-pollination: the best ideas come from anywhere and scale everywhere.

Fascinating to read about the ongoing success and scale of the social commerce pioneer Pinduoduo (a portfolio company of my previous employer). In their Q3 release, the company's revenue reached 68.84 billion yuan, marking an astronomical 94% increase from the same period last year and a substantial net increase from the previous quarter.

While the Chinese company’s overall growth is impressive this is not the focus of this article.

Rather it is about Temu, their US expansion. Temu is a Chinese discount e-commerce platform owned by Pinduoduo present in the West. Temu's growth in the US has been swift. By May 2023, it was larger than Shein, with over 100 million users - up from less than 10 million in October 2022. Its GMV rose from $3 million in September 2022 to $1 billion in June 2023. The majority of Temu's downloads, came from the United States, making it the largest market for Temu.

Zooming out, as this thoughtful piece reports: “China has been ‘the world’s factory; for decades, with made-in-China goods reaching global consumers through foreign brands, shops, or sites like Amazon….But recently, Chinese-owned shopping platforms have begun looking beyond China’s borders. Temu joins ultrafast-fashion platform Shein and TikTok’s shopping feature TikTok Shop to herald a new, global era for Chinese e-commerce.”

Amazingly: “roughly a year after its launch, Temu had more than 61 million monthly active users in the U.S…it now sells in 48 countries around the world. Shein…has been the top-ranked shopping app on the Google Play store in 115 countries.”

The dramatic rise of Temu highlights the important cross-pollination trend taking place today.

It’s not wrong to down-round

In tech, there is often a feeling of a momentous march, a prolonged path forward, punctuated by fundraising milestones - we call them seed, series A, series B and so on.

But the last few years brought us an aberration of capital and valuation. We are in a correction today.

In that vein, loved this piece arguing there is no shame in down rounds.

“Imagine you’re the founder of a successful tech startup. You’ve achieved product-market fit and raised a financing round in 2021 at a record valuation. There were even articles written about your company in TechCrunch! Since then, revenue has doubled and you’re now looking to raise another round. Unfortunately, the venture capital landscape has changed, and despite its growth, your company is worth less today than it was two years ago. What do you do? …Raising a down round is taboo in the venture capital world, forcing founders and early investors to confront a number of tough questions and feelings. It shouldn’t be so scary. Much like in the public markets, there are a number of reasons why private companies may go up and down in value. When valuations get too inflated, down rounds pull the market back to earth. We don’t have to love them, but we shouldn’t fear them.”

In my view, the important lesson is that fundraising events aren’t and shouldn’t be treated as the milestones along the way. Financing is a tool, and valuation part of the cost of accessing that tool. The milestones should be operational and impact metrics - revenue, customers, gross margins, retention… and dare I say profit. #Camels

Interesting discussions:

Reflecting on the above, the nomenclature of rounds may not even be applicable to every sector. Good piece on the unique dynamics in climate tech: unlike typical startups, climate tech often benefits from early research and development, leading to advancements that don't align with standard funding stages. This disparity suggests the need for new metrics beyond Technology Readiness Levels (TRLs), incorporating factors like scale status and capital needs for a fuller picture. As climate tech challenges conventional paths to market readiness, it's crucial for investors and industry experts to adopt a more flexible, comprehensive approach in evaluating these unique startups.

Climate adaptation is more than just a necessity. This insightful piece sheds light on the imperative need for imaginative and effective adaptive solutions in the face of climate change. “If decarbonization is the new industrialization, adaptation is the new modernization.” We will need to integrate a number of financial and ecosystem solutions - many outside of startups alone - for a broader climate response.

The first translation of my book, "Out-Innovate: How Global Entrepreneurs - from Delhi to Detroit - Are Rewriting the Rules of Silicon Valley," was in Korean. I loved this piece about Paju Book City, located northwest of Seoul, South Korea - it is a testament to the nation's deep reverence for books and the art of bookmaking. This unique city, home to around 900 book-related businesses, is an intentional celebration of literary culture, embodying the ethos of preserving and promoting the love for books. It's a place where every element, from towering bookshelves to quaint cafes, is designed to nurture and sustain the joy of reading. The presence of the Asia Publication Culture and Information Center at its core further solidifies Paju's status as a hub for book enthusiasts and professionals alike. Can’t wait to visit.

Really enjoyed this retrospective on Silicon Valley’s history. It captures the unexpected and intriguing milestones in Silicon Valley's history, starting with blimps at Moffett Field and leading up to the founding of iconic companies like HP and Intel. "From blimps to breakthroughs, Silicon Valley's journey is a tapestry of daring ideas and decisive actions, where visionaries like Frederick Terman and William Shockley laid the groundwork for a future driven by technology and entrepreneurship.”

Remote work may be the future. But we will need to reckon with its tolls as well. “There's the uncertainty about where to look, the hesitant wave goodbye at the end, the fiddling around with settings at the beginning, the unpleasantness of constantly watching yourself, and that one colleague who has really odd taste in backgrounds. All of which creates a subjective feeling for many that spending time on Zoom -- while possibly still preferable to a daily commute -- can be exhausting and somehow unsatisfying…Scientists out of Yale University recently tried to find out, and what they discovered may make you recalibrate how you use use video conferencing tools like Zoom in your own life. “

Is fintech about to enter its next era? Interesting piece chronicling some of the fintech evolutions and arguing that a number of intersecting trends may bring a shift. “Consumers have their digital banking foundation set. So what do consumers need now? They need a way to make sense of all their financial activity across institutions. Not just aggregation, but an intelligence layer that optimizes spend. That finds sophisticated wealth and tax solutions. That delivers insights about how to best allocate that consumer’s marginal dollar. The need for an intelligent solution to optimize consumer spend couldn’t have been timed better; it is arriving just as generative AI sweeps tech.”

For everyone’s sake, stop saying: “let me know if I can help”. “While this phrase entered our shared vernacular with a kind intention, it has now become a completely useless cliche. It offers the illusion of generosity and allows a meeting to conclude on an apparent high note without actually accomplishing anything.” Instead, actively reflect on how you might support the counterparty, and offer a menu of options you’d be willing and able to do.

Book of the month

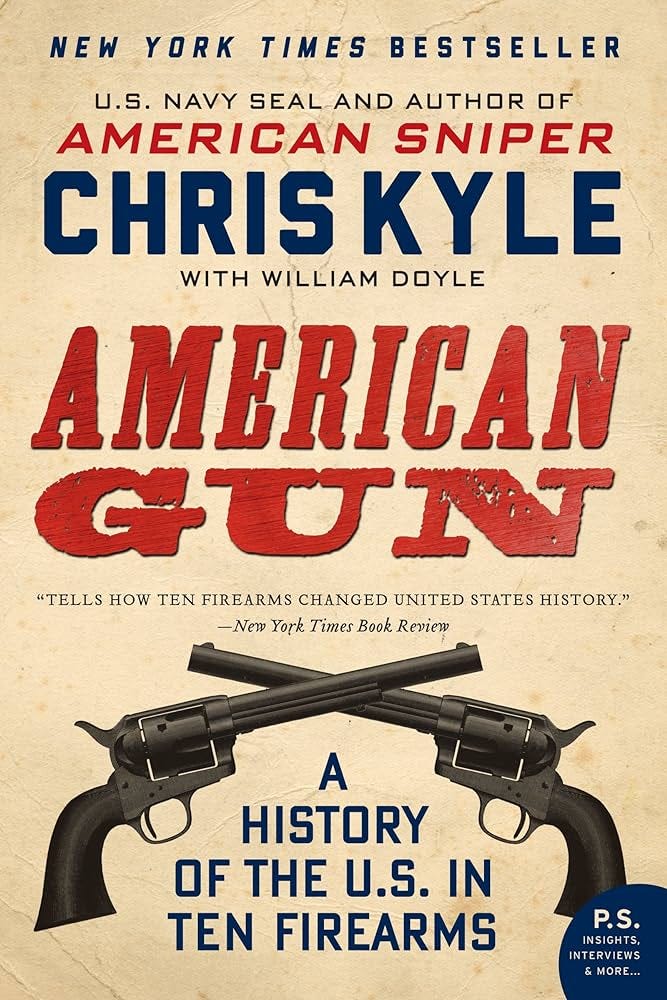

This month I read Chris Kyle’s American Gun: A History of the U.S. in Ten Firearms.

I am neither a gun owner, or in all honesty that interested by them. But I did find American Gun to provide a unique lens to look at history. What was particularly interesting was the role of innovation (and in many cases replication) to create revolutionary designs which had real consequences in the history of America.

Drawing on his legendary firearms knowledge and combat experience, U.S. Navy SEAL and #1 bestselling author of American Sniper Chris Kyle dramatically chronicles the story of America—from the Revolution to the present—through the lens of ten iconic guns and the remarkable heroes who used them to shape history: the American long rifle, Spencer repeater, Colt .45 revolver, Winchester 1873 rifle, Springfield M1903 rifle, M1911 pistol, Thompson submachine gun..American Gun is a sweeping epic of bravery, adventure, invention, and sacrifice.

The author, Chris Kyle was tragically killed before completing the book. But the product was an enjoyable and for a luddite in the weapons department like me, quite interesting.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)