VC: Hot Or Not?

Looking behind the headlines of two fascinating pieces of research

Last week, Carta released some fascinating research about venture capital trends from their data. Because they are the fund administrator to 3,000 VC funds, they have two benefits: 1) they don’t rely on self-reported data which has a certain set of biases (including of course selection bias since poor performing funds may not share their data) and 2) a large enough sample size to be meaningful.

I had shared about the post and received many questions from fellow venture capitalists and entrepreneurs, so wanted to share a few longer form thoughts.

Four trends stood out to me from their research.

This newsletter is brought to you by Earth One. This November, Earth One will convene a select group of 300 interdisciplinary and intergenerational global leaders — investors, scholars, entrepreneurs, inventors, artists, ecologists, and politicians — for a 12-day immersive experience aboard the new Ritz Carleton megayacht with the vision, capacity, and leverage to affect planetary change. The Atlantic Crossing is timed to coincide with the 2024 US Election — and the experience (and invitees) are being specifically curated to increase our capacity to integrate diverse perspectives, We invite you to join us at the Atlantic Crossing - crossing over into the world we all want to live in - and mention Fluent to fast-track your application and for access to special pricing.

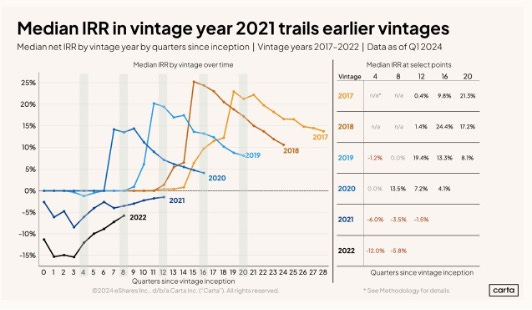

1. Fund performance is down. Way down.

Median IRR for a venture capital firm 20 quarters in is down from 21% for 2017 vintage to 8.1% for 2019. The newer datapoints don’t look much more encouraging.

A few caveats:

I don’t put much credence in the newest data. It is normal for VC funds to have a J-Curve. Poor performing companies show early, and the best performers take a long time. So looking at 2022 IRRs right now is not that meaningful.

The data is affected by ZIRP era madness, and the data is noisy because not every VC fund’s valuation policies are the same. Some are marking down 2020-2021 era investments actively while others are waiting (and praying!).

That being said, the data trend is pretty clear. Median IRRs are down in newer vintages.

Yet, despite this returns compression, venture capital remains an incredible asset class. Here is some fascinating data from JP Morgan. Despite the downturn, it still seems to be the best long-term asset class (this is not investment advice). Between 2014-2023 annualized VC returns were 16.2% IRR, compared to 14.6% for private equity, 4.4% for hedge funds, and 8.8% for direct lending.

Well what’s going on here?

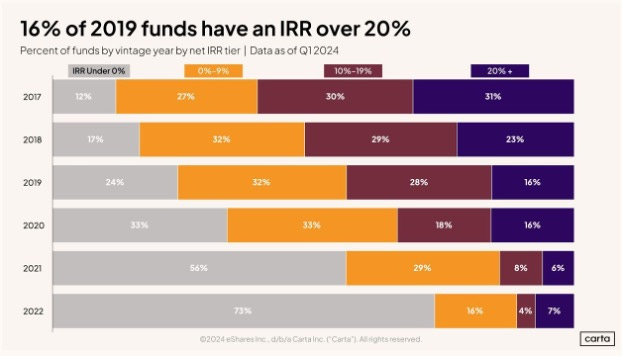

2. One hypothesis: top quartile IRR is becoming more concentrated

Like startups, there is a power law in VC returns. As I highlighted in my recent interview with Ilya Strebulaev about his new book, there has been an explosion of new VC funds in the last few years. Nearly 1000 new VC firms were created in the last few years.

As the number of firms is increasing, the concentration of top returns seems to also be increasing (it is hard to get conclusive signal from the most recent vintages since it takes time for VC funds to mature, but the trend seems consistent).

One explanation as to why is that due to the explosion in VC firms, there is a wider range of strategies, quality, and disciplined deployment (hello mega funds!) – that also happen to be fishing in the right ponds at the right time (e.g. AI funds 3 years ago).

Ok but why is concentration of returns increasing in VC funds?

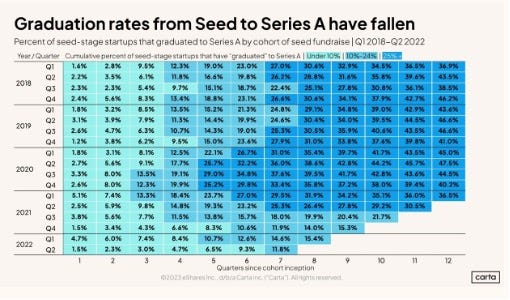

3. Graduation rates among VC startups are falling.

The reason is simple: because of what's happening under the hood of the VC funds' portfolios.

For companies started in 2018, 25-30% of companies had graduated to a Series A two years after successfully raising a seed round. Recent cohorts are half of this.

This is also at a moment where we’ve seen an increase in the amount of startups founded. For example, there are today over 150 cities that have created a unicorn – up from four in 2013!

If more companies are being formed, less companies are graduating, and there are more VC funds with presumably non-overlapping portfolios - then the power law of VC returns should naturally increase.

Where will the VC market go from here?

I have a bonus chart for you, on DPI. DPI is the lifeblood of the VC industry since this powers LPs’ ability to invest in future funds. It has decreased.

After 4 years, the percentage of VCs that have returned a single dollar is down from 37% (2017 vintage) to 21% (2020 vintage). Of course, this is still quite early to be measuring.

If you’re wondering when the VC fundraising market will come back: when VC funds start showing some DPI. But if concentration of returns continues to increase, then many VC funds will be out of business.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)