VC Returns Will Show Greater Dispersion; Early DPI Is Not (Necessarily) Good, And Other Counter-Intuitive VC Perspectives

The future of innovation is global. We discuss it here.

This piece combines a Linkedin series & my Forbes column here.

High-growth venture capital is evolving. Insights from the recent Carta VC Fund Performance Report and the SuperReturn Miami conference suggest the landscape for both limited partners (LPs) and general partners (GPs) is shifting dramatically.

VC Returns Will Show Increased Dispersion

To me, the most interesting thing about Carta’s report was putting a few pieces together.

Historically, median venture returns hover around 1x, but outlier funds can yield 50x or higher.

The paradox seems even more acute among smaller funds. Smaller funds dominate top decile returns yet at the same time show declining average performance.

I believe what we are seeing is increasing return dispersion. Several factors explain this trend:

The underlying explosion of startups is providing a broader yet more variable investable pool (backed by an explosion of early-stage emerging managers).

Increasingly outsized "home run" outcomes that disproportionately impact fund returns. And naturally there is less overlap among VC fund portfolios given above.

Larger funds consolidating investment rounds, limiting opportunities for diversified party rounds.

One implication for this expanding dispersion underscores the importance of a systematic approach to early stage venture capital or partnering with a fund-of-fund managers to identify standout performers.

Why Early DPI is Bad - Or At Least Not Always Good - Liquidity and Long-Term Value

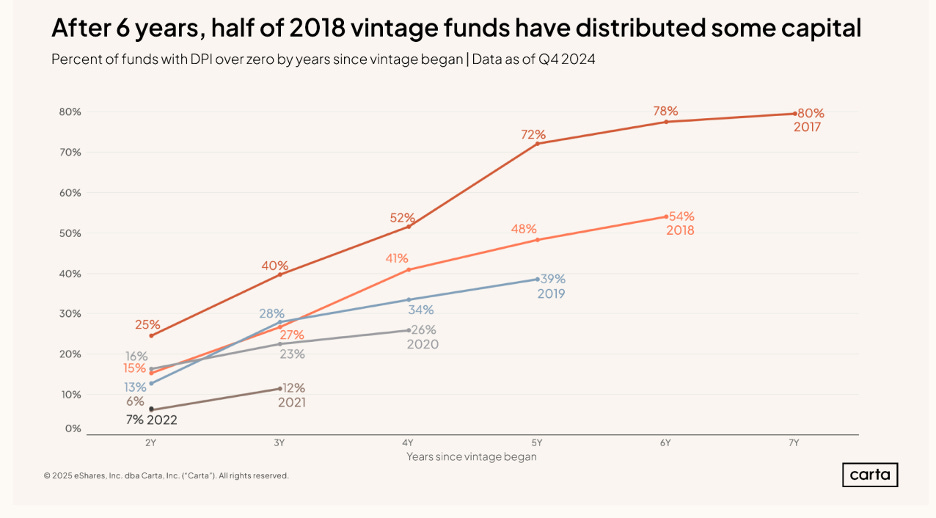

A significant concern highlighted both by Carta and at SuperReturn is the slow return of capital to LPs—measured by Distribution to Paid-In Capital (DPI). Carta noted that half of the 2016 vintage VC funds have yet to return any capital after seven years (!!!), creating severe liquidity bottlenecks. That is a problem.

But what of DPI in year 2 or 3 of a fund?

While that lack of DPI later on can be a red flag, early DPI is bad (or not necessarily good!)—particularly for early-stage venture capital funds.

Fast DPI is a signal not of outlier success, but rather of early exits at modest valuations.

Startups are not mature companies—they are experiments in search of scalable business models. Generating early DPI often means the companies were acquired early, before their true potential was realized. As a result, these early exits can dilute overall fund performance and reduce the chance of producing venture-scale returns.

A VC fund has only so many “bullets”, or investments. An early small acquisition, while nice from a liquidity and IRR performance, is like shooting a blank.

Funds with high early DPI often miss out on the compounding upside of long-term growth. For instance, portfolio companies of mine, like Chime, Sidecar Health, Neon, Kin Insurance, and ZenBusiness all took years of iteration to reach meaningful scale. These are not quick exits—they are multi-year journeys. That’s often what it takes to build generational companies.

A VC fund has only so many “bullets”, or investments. An early small acquisition, while nice from a liquidity and IRR performance, is like shooting a blank.

So, why is early DPI not necessarily good for long-term returns?

- Premature Exits: Quick DPI typically results from small exits, not unicorn outcomes.

- False Signals: Early returns may attract attention, but they often mask underwhelming fund performance over time.

- Missed Compounding: Early distributions remove capital from high-potential investments just as they’re poised for explosive growth.

This is not to say DPI doesn’t matter—it does. And as a later section reflecting on SuperReturn Miami, DPI matters more than ever. But in early-stage investing, patience and discipline are often more predictive of success than quick liquidity.

The liquidity crunch from reduced IPO and M&A activity has intensified LP focus on exits. Secondary sales have emerged as critical alternatives, with a 45% rise in secondary private equity transactions reported in 2024. However, it's crucial to recognize that liquidity events like IPOs are part of a longer journey rather than definitive endpoints.

VC Funds Will Have More LPs: The Changing Face of LPs

Historically, VC funds have maintained surprisingly small LP bases. For instance, Carta reports that among sub-$10 million funds, 75% have fewer than 44 LPs. Even large funds over $250 million typically have fewer than 135.

But this trend is likely to change rapidly, driven by several factors:

Regulation

Recent SEC decisions have expanded the allowed LP base, enabling even small funds under $12 million to raise from up to 250 LPs.

Community Engagement

Funds are increasingly tapping into LP networks for operational expertise and deal-sourcing advantages. At Fluent Ventures, over 50 unicorn or exited founders contribute strategic insights. Similarly, Rally Cap VC has built a large operational community.

Capital Dynamics

Despite tighter fundraising markets reducing average individual LP check sizes, interest in venture capital as an asset class continues to grow.

Technology Platforms

Innovations by platforms like AngelList, Sydecar, and NAV Consulting (Fluent’s fund admin) are simplifying fund administration and facilitating parallel structures for diverse investor types.

These trends will likely lead to a proliferation of LPs within the venture ecosystem, reshaping fundraising strategies and broadening community-driven investment models.

SuperReturn Miami Takeaways: From Momentum to Reality

SuperReturn Miami echoed these insights, emphasizing a shift from momentum-driven investment strategies to disciplined diligence. LPs are increasingly prioritizing realized returns (DPI) over paper valuations amid ongoing market uncertainty. The era of FOMO (Fear Of Missing Out) investments—characterized by rapid deal velocity and elevated valuations—appears to be ending. Investors are now emphasizing thorough due diligence, exemplified by firms such as Fuel VC, which incorporate deep technical expertise into their investment processes.

AI emerged as a significant theme, highlighting dual trends: market concentration and capital efficiency. Large VC firms are facing pressure to deploy significant capital, potentially inflating valuations artificially, while AI-driven startups, or "camel seed-strappers," are reaching profitability faster with lower capital needs.

This dynamic may result in tension between traditional venture fund strategies and emerging capital-efficient business models.

Furthermore, alternative liquidity solutions were extensively discussed. Secondary markets have become increasingly vital, including internal continuation funds and secondary sales at the GP or LP level. Additionally, industry leaders noted the evolving perception of IPOs, emphasizing that going public is merely a new phase rather than an ultimate exit.

Despite ongoing liquidity challenges, enthusiasm for private markets remains robust. Areas like private credit continue to expand rapidly, attracting LPs interested in diversification and non-correlation with public markets. ESG considerations, though facing scrutiny, remain integral to due diligence processes as investors seek sustainable returns and risk mitigation.

Ultimately, SuperReturn Miami signaled a return to measured optimism—a thoughtful recalibration rather than retrenchment—acknowledging uncertainties in market dynamics and regulatory environments but also emphasizing opportunities created by disciplined, thoughtful investment approaches.

Conclusion

The venture landscape is evolving toward greater LP inclusivity, disciplined diligence, nuanced liquidity management, and more pronounced return dispersion. Understanding why early DPI is bad—and how long-term thinking and operational patience yield better outcomes—will be a critical factor for both emerging managers and experienced LPs navigating the next era of innovation capital.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)

Right on Alex. Good post!