Innovation supply chain + 2022 predictions

Happy Thanksgiving, social commerce, forecasting 2022 global tech and fintech trends

Predictions

Hi All - For those celebrating, Happy Thanksgiving!

Like the stores in San Francisco that put up Christmas decorations too early, I’m sending this email today asking for your 2022 predictions. Next month, I’ll publish the top predictions I receive about shifts in tech globally and in fintech specifically. Please send me your best by replying to this email!

The Innovation Supply Chain & Social Commerce

In Out-Innovate, I have written about the innovation supply chain: how the best ideas are increasingly coming from anywhere and scaling everywhere.

One such movement is social commerce, which emerged as a force in China to drive internet adoption and e-commerce usage, particularly in 2nd, 3rd and 4th tier cities. Pinduoduo, the Chinese leader (and portfolio company of Cathay Innovation, the fund I work at) emerged as the leader, and was the fastest growing e-commerce company of all times (today worth >$100b on the nasdaq). It also became a powerful channel for financial services distribution and inclusion.

This movement is scaling globally with emerging leaders in different ecosystems around the world. In this post, I wanted to share some lessons from Brazil, and its emerging leader: Facily.

I have had the pleasure of working with, and investing in, Facily since their $13m Series A. They just came out of stealth, announcing their $250m Series D and a cumulative $366M raised alongside world-class investors such as Delivery Hero, Tiger Global, Quona Capital, Luxor Capital, Founders Fund and many more.

In this post, adapted from the Behind The Term Sheet post (co-written with my colleagues at Cathay Innovation), wanted to share some learnings about what drove social commerce in China and why it matters in Brazil and globally today.

The barriers to e-commerce in Latam

E-commerce penetration is strikingly low for many parts of the world, especially in emerging markets. In Latin America (Latam) for example, the retail market is a $2T industry but e-commerce surprisingly remains an untapped opportunity with a 3% penetration rate.

Why? There are several reasons:

1. Ignoring underserved segments: Existing e-commerce platforms (e.g., Mercado Libre) have historically focused on higher-income segments, leaving behind the majority of the population in the lower-income bracket.

2. High delivery costs: Most Latam consumers are price sensitive, unwilling to pay for freight costs (especially for everyday goods).

3. Limited payment methods: Similarly, most don’t have a credit card — which is required for the majority of e-commerce platforms.

4. Building trust with first-time users: While Latam has a large online population (47% are WhatsApp users), newer digital platforms still need to gain consumer trust.

Some of these similar dynamics were at play in China a few years ago.

Dismantling the barriers to e-commerce — the Pinduoduo story

In China, in 2015, e-commerce accounted for 15.9% of total retail sales and was forecasted to reach 33.6% by 2019 — one of its fastest-growing segments.

Yet, the market was still largely dominated by platforms such as Alibaba and JD, mainly servicing the upper end of the income bracket. Enter Pinduoduo (PDD) — an e-commerce platform that sells a wide range of products from home goods to clothing. It’s also one of the fastest growing e-commerce platforms to date, going from a less than US $10M run-rate in 2016 to more than $15B in under 18 months and eventually going public on Nasdaq in 2018 with a $30B valuation. Today, PDD is valued over $110B and has 788.4M users, more than Alibaba.

PDD both leveraged and accelerated several shifts taking place in consumer behavior at the time:

1. Mobilization: Mobile online shoppers had reached 300M with ~70% penetration rate

2. Socialization: WeChat was transforming the way people engage and shop with 70% of users buying items through the platform

3. Consumption upgrade: Rising consumption of higher quality lifestyle products and services

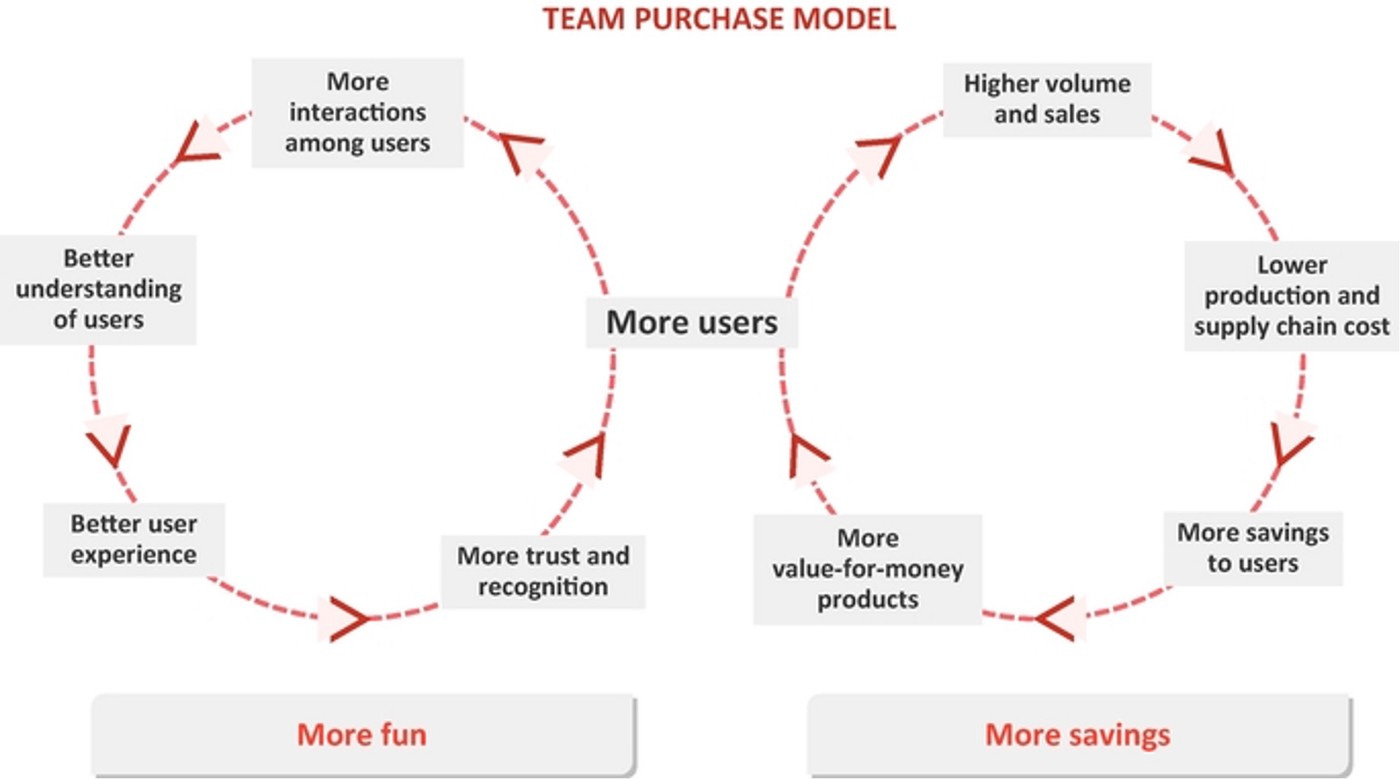

PDD’s unique model leveraged the engaging WeChat community — practically defining the category of social commerce in China. It allows WeChat users to create “team purchases,” inviting others to form a shopping group to receive lower prices. This recreated online shopping by encouraging a more interactive experience — furthered by the company implementing in-app games for users to receive special discounts and prizes.

Unlike competitors, PDD got its start by focusing on the lower-income segment in lower-tier cities which accounts for 65% of PDD’s total user base — while 57% of JD’s user base comes from tier 1 and 2 cities:

The products on PDD are mainly low-ticket items and everyday goods such as groceries. Produce has specifically become a big focus.

PDD has been able to spur local supply chains. For example, PDD recently enabled millions of farmers from poverty-stricken areas, both through agronomic knowledge and e-commerce know-how, to earn produce sales revenue of more than $9.7B. By bypassing unnecessary intermediaries, PDD allows farmers to small manufacturers to offer goods to consumers directly and secure a better price for both parties. It also works with last-mile delivery vendors to reach customers faster.

Latin America — on the brink of its e-commerce moment

The trends behind PDD’s rise are starting to play out in Latam. Internet and mobile penetration rates in Brazil and Mexico are accelerating and already exceed those of China and India per the chart below.

Brazil has one of the most avid mobile user populations globally, with 71% of Brazilians using mobile phones to access the Internet and 120M+ using WhatsApp — a core platform in the region. Whatsapp offers a powerful platform for e-commerce to tap into engagement for consumer transactions and C2B (consumer to business) connectivity leveraging lessons from China.

Facily, learning from PDD

Facily leverages many of the learnings of PDD in China, but adapted to the local context.

Instead of WeChat, Facily leverages WhatsApp to enable users to make group purchases for discounts. The company offers a marketplace with everyday goods at low prices. Users can share purchase links with friends and family and receive items on demand or pick up at designated points. Facily also has in-app games to enhance engagement and virality.

Facily targets the underserved lower-income segment (most being first-time e-commerce users). Many of its customers are underbanked. To pay, Facily accepts cash, PIX (central bank digital payments platform) or boletos (a popular voucher-based method). This kind of optionality opens e-commerce access to a greater population.

One of Facily’s unique characteristics is its network of pick-up points for distribution — this not only reduces logistics costs, but it increases foot traffic at locations as a major incentive for merchants and partners. Today, Facily has over 11,000 pick-up points across Brazil and counting. In addition, the company works directly with suppliers and manufacturers to maintain low prices while empowering small, local suppliers to reach greater audiences through its marketplace.

The innovation supply chain in action

The Facily model demonstrates the innovation supply chain in action. The best ideas come from anywhere and are scaled everywhere. They improve and evolve along the way to match local contexts. In the case of social commerce, the model originated in China, but is scaling around the world, with large players like Facily in Brazil or Mesho in India. The model does not copy-paste of course. It requires real adaptation and local expertise to work, with different solutions (e.g. pick-up points in Brazil).

We will see these trends only accelerate in the years to come.

Onwards.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)