What the World Taught Me About Chime

Geographic arbitrage: when global models build conviction at home

Most people look to Silicon Valley to see the future. As many readers in this newsletter know, I’ve often found it helpful to look elsewhere.

Years ago, while working at a previous firm, Omidyar Network, we were exploring the rise of neobanks globally. I saw models that worked: apps that offered mobile-first banking to underserved consumers, built trust in low-trust environments, and scaled profitably. I didn’t know it then, but these learnings would help me get to conviction on one of the biggest U.S. fintech stories of our time: Chime.

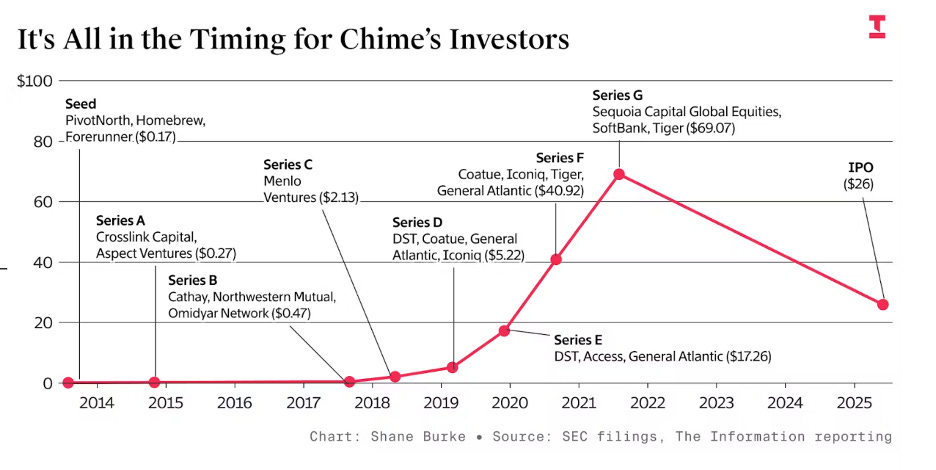

I am grateful to Chris, Ryan, and Matt for the opportunity to support them at the Series B. Investing in Chime was also how I eventually met Cathay Innovation, which led the round, and where I eventually worked for 5 years, before launching Fluent Ventures.

As Chime (NASDAQ: CHYM) went public this week, it’s easy to frame it as a classic Silicon Valley success. But to me, it’s something more interesting: a case of geo-arbitrage—where global patterns helped de-risk what looked like a novel U.S. play.

Let me explain.

The Global First-Movers

Before Chime, there was Tinkoff in Russia. Founded in 2006, it built a full-stack digital bank in a market with poor infrastructure and low consumer trust. It began with credit, scaled without branches, and became one of the world’s first profitable neobanks.

In the 2010s, Europe’s neobanks entered the scene. Monzo, Revolut, and N26 targeted digital natives disillusioned with high fees and poor UX. They began with checking accounts or foreign exchange and expanded horizontally. But in Europe—where interchange fees are heavily regulated—they had to get creative. Their model relied on cross-selling paid subscriptions, lending, and add-on products to make the economics work.

Then came Latin America. Nubank launched in Brazil with a different approach: credit-first. Credit card penetration was low, interest rates were high, and consumer pain was real. Nubank became a beloved brand by offering radically better credit to millions of previously excluded users—and then expanded into a full suite of financial services.

On the other side of the world, in Korea, Toss built a financial superapp. It started with payments and evolved into a multi-product ecosystem spanning insurance, investments, and even healthcare. Its playbook wasn’t about monetizing a single product, but about becoming the trusted financial platform for daily life.

Different geographies. Different products. But a shared insight. Customers were looking for a modern banking experience. They wanted clear and transparent products, no hidden fees (overdrafts at the time were still a $30b+ industry!), convenience and simplicity. They wanted to be treated with dignity and respect.

Chime’s Unique Model

The U.S. financial system is paradoxical. It’s the largest in the world, yet it has some of the most dysfunctional consumer banking experiences. Tens of millions of Americans live paycheck-to-paycheck, hit with overdraft fees, account minimums, and confusing disclosures.

That’s the market Chime entered. Chime’s wedge was simple: a no-fee checking account with early access to direct deposit and no overdraft penalties. But behind that simplicity was a sophisticated strategy—one rooted in U.S.-specific regulatory arbitrage.

Thanks to the Durbin Amendment, banks under $10B in assets are exempt from interchange caps. Chime partnered with Durbin-exempt banks and was able to monetize debit card usage,which made every swipe profitable.

And because Chime won when its customers used the product, they were deeply aligned with creating a long-term relationship.

While Nubank used credit to grow LTV, Chime used debit. While Revolut sold add-ons, Chime scaled with trust. While Toss built breadth, Chime focused on simplicity.

The model was tailored to the American context—but the conviction came from understanding how these patterns had worked globally.

What Chime Got Right

Product and economics aside, what truly set Chime apart was its customer focus.

It didn’t just eliminate fees. It reimagined the entire relationship between a bank and its customer:

Get paid early gave users liquidity when it mattered most.

No overdraft fees meant no punishment for being poor or not paying attention to your balances. They also created a SpotMe feature for small microloans.

Transparent communication reduced anxiety around balances and bills.

Responsive support made users feel seen—not just serviced.

In doing so, it built a brand that stood for something. Chime wasn’t a disrupter. It was an ally. That’s a powerful thing in a country where nearly half the population struggles with financial fragility.

The Lesson: Geo-Arbitrage Goes Both Ways

As venture investors, we often talk about exporting U.S. models globally. But geo-arbitrage works in reverse too. Sometimes the best way to understand an opportunity at home is to see what’s already been proven abroad.

Chime looked like a bold bet. But to anyone watching the neobank revolution unfold from São Paulo to Seoul, it felt inevitable.

The Series B investment is up from $0.47/share to $43 at it’s stock market debut. Geographic arbitrage worked.

Critically, geo arbitrage is not copy-paste. But it provides mental scaffolding to believe Chime could work—uniquely adapted to the U.S. market. It is also what led my investment in other neobanks globally, including Neon (a unicorn in Brazil).

What’s Next?

As Chime enters the public markets, it’s more than a fintech success story. It’s a reminder that innovation doesn’t just flow from Silicon Valley out to the world. It flows in every direction. This is what I call the innovation supply chain.

If we want to see the future, sometimes we just need to shift our gaze outward.

Because of the next category? It might already be winning—in Jakarta, in Lagos, or in São Paulo.

We just have to pay attention.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)