Fluent Funding

Following Zetwerk’s Scale And Prima’s Rise – A New B2B Manufacturing Platform In Mexico

We’ve all seen the headlines. In 2024 and 2025 the story was about tariffs. During the pandemic it was supply chain dislocations from lockdowns (over 90% of Fortune 1000 companies experienced supply chain disruptions!) On top of that, there are national security and sovereignty concerns that are rising.

Supply chain has and continues to become more complicated. In this piece, we wanted to highlight a thesis area for Fluent, introduce one global unicorn, and publicly share about an investment we made last year.

A technological lifeline

Fortunately, new technology platforms are rising to help solve some of these issues.

In India for instance, Zetwerk emerged as a pioneering model for manufacturing. Its platform connects businesses with a vast network of vetted manufacturing partners, streamlining the entire production process from design to delivery. Zetwerk’s success, with over 1,800 active customers and 9 million+ parts manufactured, validates the effectiveness and scalability of this model. They are presently valued at $3.1 billion and likely going public this year.

An important driver for Zetwerk’s growth has been the increasing China+1 strategy, where, due to geopolitical tensions and supply chain vulnerabilities, companies diversify their production by establishing operations outside of China. This shift has brought its own set of challenges, including infrastructure gaps, regulatory and cultural differences to address in the new geographies and other transition costs. The need for new models enabling visibility and transparency across the entire process, while prioritizing efficiency and speed, once more becomes paramount.

In an upcoming 99%Tech episode we will deep dive into Zetwerk! Please subscribe if you’re interested to stay in the loop.

Fluent’s Thesis

Our thesis at Fluent Ventures is global replication. The biggest problems are global but often won by local champions.

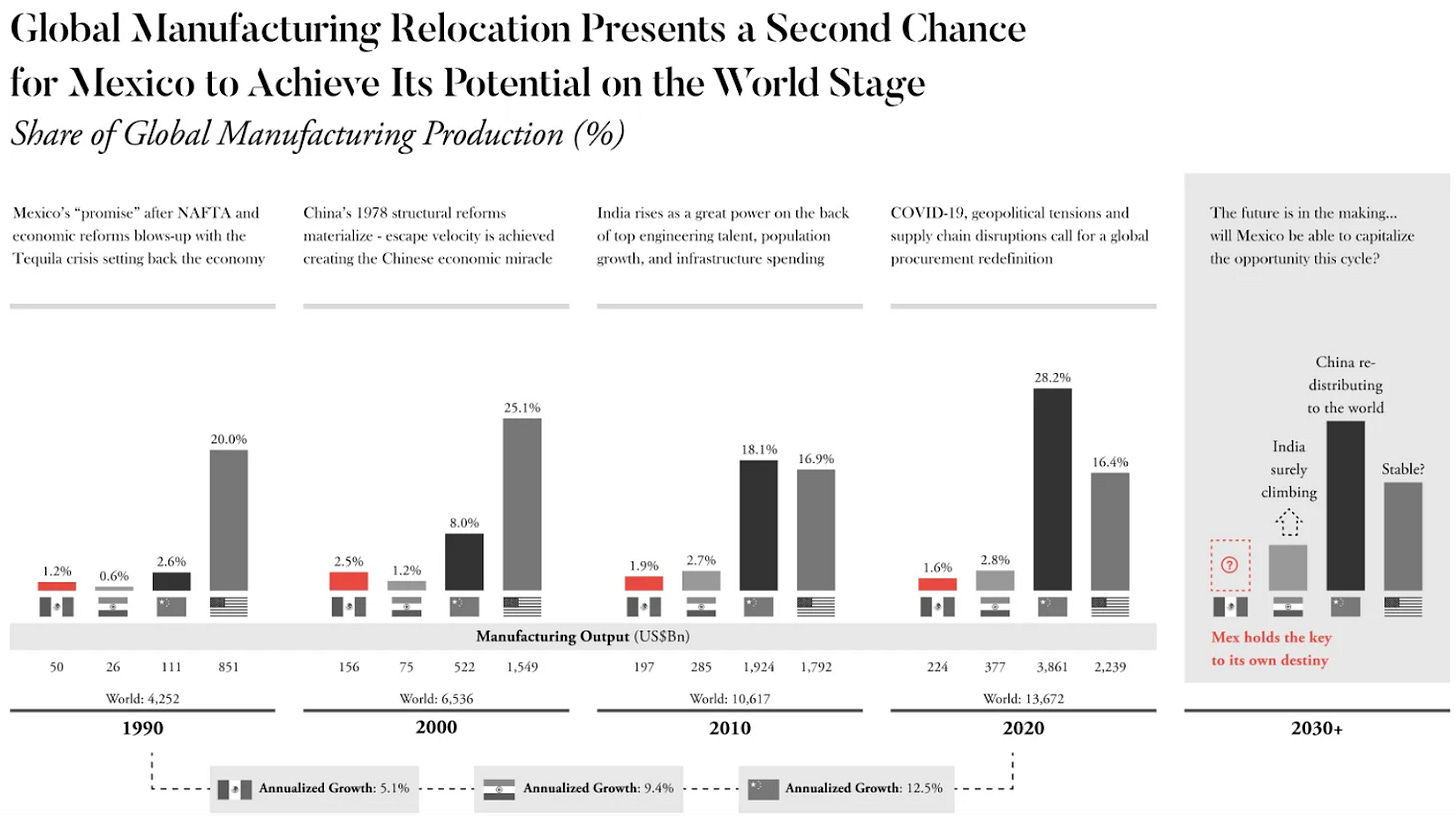

In this case, we believe this supply chain shift will clearly not be unique to India. One market that has benefited from nearshoring already is Mexico.

After searching for a year for a business like Zetwerk in Latam, we met the Prima team, and knew we were looking at the next breakout player in the space.

Prima’s Story

Prima recently announced it has raised $42.5 million. Fluent was an early investor in the business, partnering with firms like Acrew, Nazca, Quona Capital and Greenoaks amongst other investors. Our investment in Prima is an example of Fluent’s geographic alpha strategy in action. We believe Prima came at the right time, to address real pains, in a huge industry ripe for disruption. This is the reason we wanted to share more on why we invested in Prima.

Meet the founders

No business model matters without the right founders. Daniel Autrique, is the unicorn founder of Klar (the Nubank of Mexico). Juan Pablo Ramos,, worked at some of the fastest growing technology companies, often leading the Latam operations, including Uber Eats and Loft. Patricio Servitje, worked with Posadas and The Boston Consulting Group. They know each other from Stanford.

We had a chance to get to know the founders while co-hosting an event with the Council on Foreign Relations on technology solutions in supply chains, where Daniel was one of the talks of the show!

The LatAM opportunity

Over the last years, Mexico has experienced a surge in manufacturing activity, fueled by the nearshoring trend, where North American companies are shifting production closer to home. By 2023, Mexico supplanted China as the #1 exporter to the US, and the country's annual industry growth was more than double than the last 10 years average. Yet, this increasing demand is hardly seized by an industry filled with inefficiencies.

The manufacturing industry in Mexico (and more broadly across LatAM) is enormous. With close to 600k businesses, is not only highly fragmented, but also filled with micro companies (only ~1.5% of these factories have over 100 employees). The micro and SMEs are characterized by low sophistication, still relying largely on manual processes (it is estimated that less than 15% of sales in the manufacturing industry are internet enabled). This makes them very inefficient, with significant excess capacity and huge administrative burden.

On the other side, there is an unmet demand for customized products. The problem is exacerbated by different pains across the supply process, including inefficient and decentralized discovery, long and filled with errors RFQs, and poor quality on deliveries.

The combination of both, growing market and industry ripe for disruption, represents a perfect mix for a player to address these pains and take advantage of the developing opportunity.

Prima’s Product & Vision

Prima is looking to become the digital manufacturing and supply chain integrator in Latin America, disrupting the enormous manufacturing industry in the region. By offering end-to-end solutions, Prima seeks to solve the most critical needs of the industry, offering value to both, supply and demand stakeholders.

For suppliers, Prima provides access to a larger pool of potential clients, enabling them to expand their business and increase revenue. The platform also simplifies quoting, project management, and logistics, freeing suppliers to focus on their core manufacturing expertise. Further, the company's financing options will help suppliers overcome working capital constraints and unlock growth opportunities.

For buyers, Prima acts as a seller of record and single point of contact for all manufacturing needs, streamlining the sourcing and procurement process. Prima provides competitive pricing for its clients, maintains strict quality control standards and guarantees on-time in-full (OTIF) deliveries. By placing itself at the center of the operation, Prima will continue its vision to digitize the entire workflow of the manufacturing industry.

The Context

The world has changed since our investment in the company last year, including with the new US administration. However, we believe Zetwerk style business that helps localize and evolve supply chains will become increasingly important in LatAM. A number of self-reinforcing trends explain why this strategy is possible today.

Global supply-chain disruptions after the pandemic: Supply-chain disruptions forced a massive re-evaluation. This is a catalytic moment and a big opportunity.

Existing Manufacturing Prowess: Both Mexico and Latin America have established manufacturing industries. The availability of skilled and low-cost labor (direct labor is estimated to be 70% less expensive), existing infrastructure, and supply chains can facilitate smoother entry and growth.

Cost Competitiveness: LatAM’s overall lower operating costs has made it a key destiny for large global manufacturing companies.

Nearshoring/friendshoring trend: There has been a trend of North American companies nearshoring their manufacturing operations to Mexico because of proximity and that it is an ally. TBD of course on the new potential tariffs, though Prima has shared its own perspective.

B2B commerce tech enablers: Digital payments, logistics, data analytical tools, and commerce infrastructure tech has already been developed, making it possible to build and grow a solid platform without incurring in exorbitant costs.

Growth Potential: Mexico and Latin America are emerging markets with significant growth potential. The demand for manufactured goods is likely to rise, creating opportunities for businesses like Prima.

The next few months will certainly be volatile as supply chains get reconfigured. We also view this as a big opportunity for dynamic players. We think Prima will be part of this new wave and are excited to be part of their journey.

As part of our fund strategy, we are always looking for founders that are building in proven business models that we believe can be replicated around the world. If you are building a B2B platform, we would love to connect! Please reach out to investments@fluentvc.com.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)

Prima’s rise shows how tech driven platforms are reshaping supply chains in LatAm, just like Zetwerk did in India. The mix of nearshoring trends and digital transformation feels like a perfect storm for disruption. Curious to see how Prima tackles inefficiencies in such a fragmented market. Are they planning to expand beyond Mexico anytime soon?