Introducing Fluent Ventures & Geographic Alpha

The Best Ideas Come from Anywhere and Scale Everywhere

In 2013, when I started investing in venture, only four ecosystems consistently produced billion-dollar startups: Silicon Valley, China, Israel, and London. Zero investors on the Midas List joined its ranks from having made a global investment.

Today, over 150 ecosystems around the world have created unicorns, and this is increasingly where the largest venture returns are coming from.

Yet, innovation does not replicate or copy Silicon Valley. At least not anymore. It follows the innovation supply chain.

The best ideas come from anywhere and scale everywhere.

Yes, big companies are clearly being built outside Silicon Valley. What is underappreciated is that they are some of the largest.

The largest neobank is from Brazil, the largest superapp is from China, the largest hotel startup is in India and the largest RPA is from Romania. In each of these, the innovation supply chain has taken hold, inspiring local adaptors and global replicators.

It is this foundation that helped me invest in companies like Chime, Banco Neon, Kin, ZenBusiness, Sidecar Health, Kueski, Xepelin and more while at previous firms.

And this month, I’m proud to have unveiled Fluent Ventures — a global venture firm focused on capturing this opportunity.

Fluent’s Strategy: Geographic Alpha:

Fluent Ventures believes the future of innovation is global, but crucially, requires local execution. Fluent backs founders replicating proven models into new geographies or industries. Fluent has supported models drawing inspiration from U.S. based startups like ZenBusiness, Ramp, Brex, and Rippling. However, increasingly, inspiration is coming globally, and Fluent has backed models emerging from Japan, Brazil, China, and India that are being replicated elsewhere.

To execute this playbook, Fluent is backed by 75+ unicorn founders, exited entrepreneurs, venture capitalists, technology luminaries, strategic corporates, and family offices around the world—among them David Vélez (Nubank), Sean Harper (Kin), Adal Flores (Kueski), Nick Nash (SEA Group), and Akshay Garg (Kredivo).

“Business models don’t copy-paste. Context matters,” said David Vélez, cofounder and CEO of Nubank. “A lot of concepts that solve global problems can globalize—but the opportunity size isn’t the same everywhere. Fluent gets that. They understand local context better than most.”

In just two years, Fluent has made early investments in companies operating across Guadalajara, Jakarta, Lagos, London, Los Angeles, Mexico City, New York, Riyadh, San Francisco, and São Paulo, reflecting its commitment to identifying high-potential founders regardless of geography.

A Changed Ecosystem

When I wrote my first book, Out-Innovate: How Global Entrepreneurs – from Delhi to Detroit – Are Rewriting the Rules of Silicon Valley (Harvard Business Review Press), the world seemed simple. The thesis was that innovation globally would catch-up, but would take a different playbook.

That worked. But, oh how the world changed since then.

From borderless dealmaking during covid, today, borders are seemingly rising around the world. Just look at the tariffs in the US. Yet at the same time, information is more porous than ever.

AI means anyone, anywhere, can replicate and localize an idea, adapting it to local needs. In 2013, there might have been a few years lag from a US success to local experiments; today it is months.

Local entrepreneurs are spinning out of mafia generators – trained in how to move fast in their local markets. They are backed by local funds, many of whom I call friends from Kauffman Fellows.

And while we have come down from the 2021 ZIRP infused madness, to today’s more sober reality, our focus remains the same. We back simple businesses, offering products real customers value and pay for, and who do not blitzscale. Yes, “camel startups.”

We created Fluent Ventures for this moment.

How We Do It:

1. Community First

Fluent’s Venture has built this into its team design. We have specialist venture partners like Lucas Ward (co-founder of the climate insurance unicorn Kin), JC Glancy (co-founder of the unicorn ZenBusiness and Candosa), Clay Kellogg, (co-founder of Terminal and team building specialist) and Rakesh Apte (our in-house AI operations expert).

Our team and LPs are not just investors — they are partners. They open doors, share playbooks, and coinvest alongside us. Many have scaled companies from zero to IPO. Their experience and networks help our portfolio companies move faster and smarter. We also look to coonect our portfolio companies with other founders around the world, fishing in the same pond.

“Fluent is a unicorn in the global VC ecosystem. They’re filling a critical gap—backing founders in places where patience and a deep grasp of context are the real competitive advantages.” - Sylvana Quader Sinha, Founder & Chair, Praava Health & Fluent LP (Bangladesh/India)

2. A Systematic, Research-Driven Approach

At Fluent, we endeavor not to invest reactively. We run systematic global research on business models that work. We study why and how they succeed. We use AI and proprietary frameworks to search across emerging markets, looking for the right founders in the right markets at the right time.

For example, we recently did a deep dive on the implications of generational transfer on small business, the role of emerging unicorns like M&A Research Institute (AI SMB broker) and Teamshares (tech enabled roll-up + employee ownership platform), and their potential for global replication. We have already invested in two players in this category.

“Alex’s perspective is globally informed, but he’s never afraid to get into the weeds,” said Ademola Adesina, founder of Sabi. “What I love about Fluent’s approach is its focus on local adaptations of global models—that’s exactly what we’re doing at Sabi in Africa, and what I see across Southeast Asia and Latin America too.”

3. Deep Sector Support

We focus on areas we know deeply: principally in fintech, commerce, and digital health. And we hope to support entrepreneurs with the whole of our platform. We hope to become a reference point in these categories, seeing parts of the movie play out around the world.

“When Alex joined our board at ZenBusiness during our Series B, I quickly realized how strategic and thoughtful he was,” said JC Glancy, cofounder of ZenBusiness and a Fluent Venture Partner. “His curiosity and insight helped us navigate key inflection points—and that same approach is core to how Fluent partners with founders.”

“Firms like Fluent that specialize in business model adaptation and company building have a long-term advantage,” said Allen Taylor, managing partner of Endeavor Catalyst. “Fluent isn’t just global in scope—it’s strategic in how it connects lessons across ecosystems. That positions them for the next generation of venture capital.”

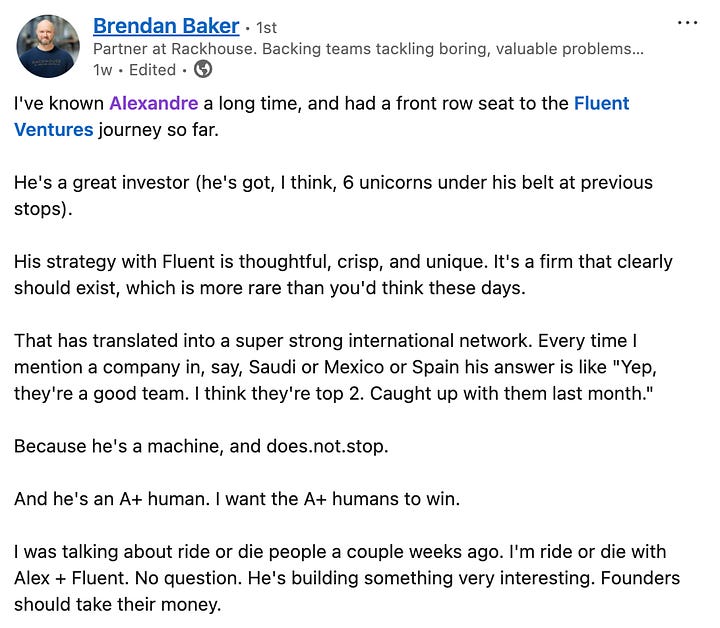

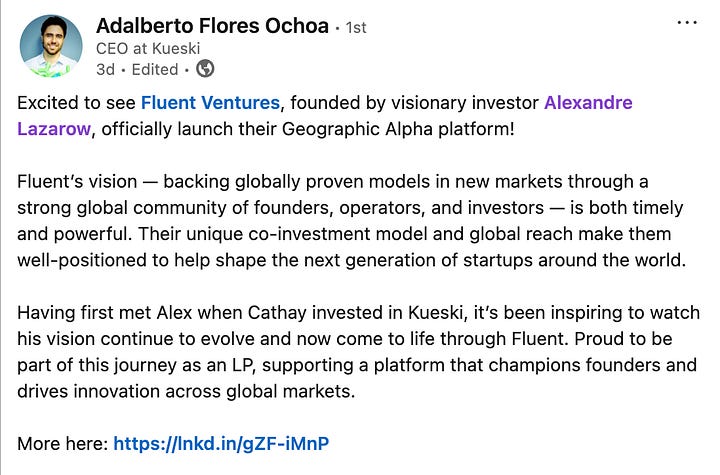

What People Are Saying

We have been humbled by the early coverage and support from the ecosystem, including a subset below, across the U.S., Canada, Latam, Asia, Africa and Asia.

But the thing that makes me proud is the feedback from our LP community, many of whom shared their experience working with us and our LP community.

Onwards

When I started my journey in venture capital, most funds were built around one idea: invest early in Silicon Valley, and wait for winners.

That world has changed.

Today, the best ideas can come from anywhere — and, thanks to technology, they can scale everywhere.

If you are building a company that embodies this spirit— we would love to hear from you. And if you are looking to follow what we are up to, please subscribe here.

Let us build the future, everywhere.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)