Why We Invested In Jutro and The Venture Case For (*SOME*) AI-Powered Roll-Ups

The future of innovation is global. We discuss it here.

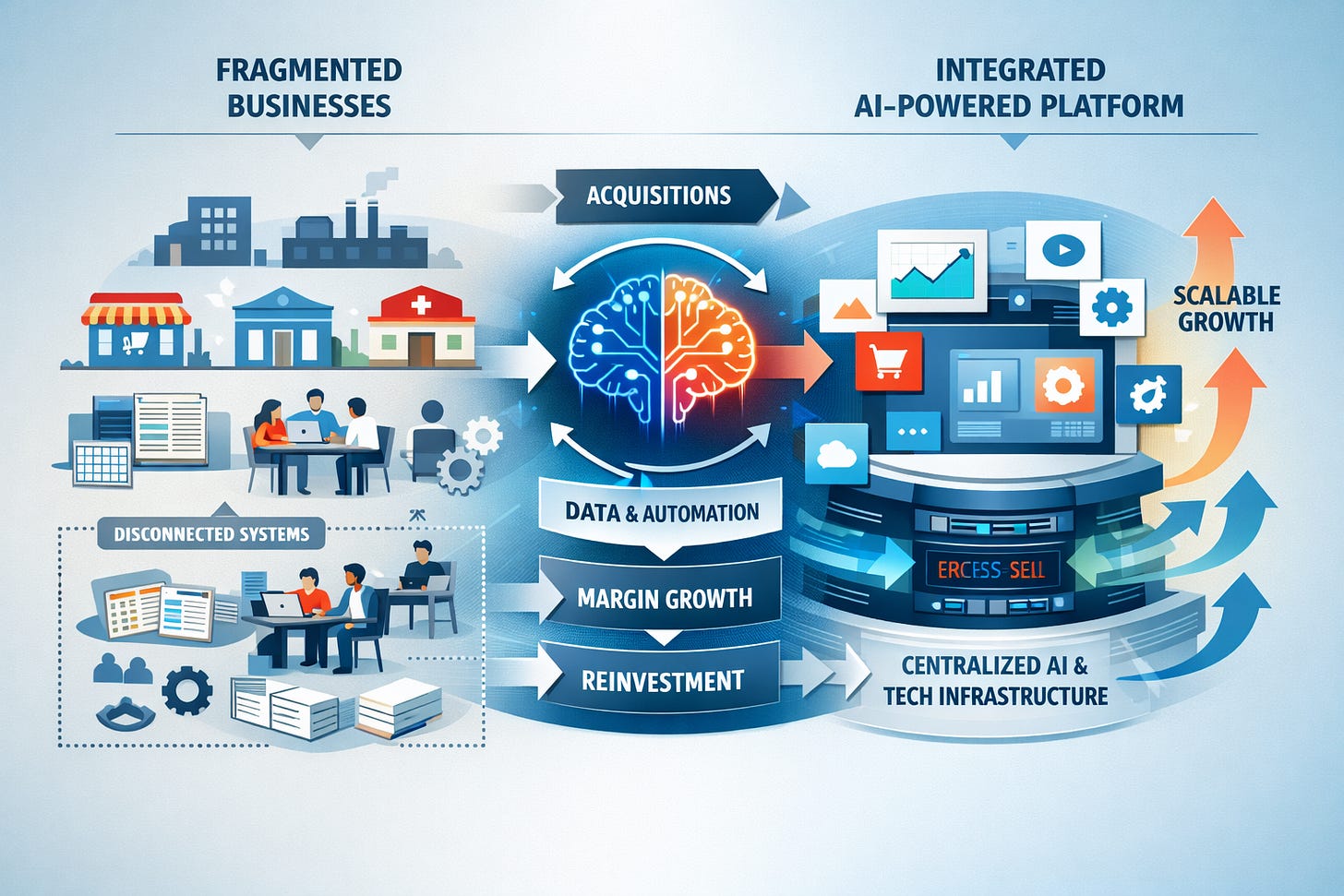

For decades, roll-ups sat squarely in the domain of private equity and search funds. These strategies depended on predictable cash flows, margin expansion, and the disciplined application of an operating playbook—none of which fit neatly into the traditional venture toolbox. But a quiet shift is underway. AI is collapsing the cost structure of integration and making once-specialized operational capabilities accessible to lighter, faster teams.

This change opens a narrow—but meaningful—window for something new: venture-style roll-ups. The model isn’t for everyone. Most attempts will struggle under the weight of integration complexity and shifting incentives – and won’t turn out to be venture sized outcomes. Yet for the 1% that get the structure, timing, and strategy right, the return profile can be extraordinary.

At Fluent Ventures, we’re excited to announce our recent investment in Jutro Medical, an AI-first primary care operator in Europe applying this model in one of the most operationally complex sectors. Founded in 2020, Jutro operates 20 clinics across Poland, serves over 120,000 patients, and has built its own end-to-end EHR and AI layer to standardize and automate clinical operations at scale. They just announced a EUR36m round led by Warsaw Equity Group, alongside local VC funds like Inovo and Kaya. Read about the Series A here.

In this piece, we wanted to share more about our thesis about this category, and our thinking behind the investment. At the core, an AI roll-up requires the possibility for meaningful margin expansion and plentiful affordable targets.

Margin Improvement: The Irreducible Starting Point

Every successful AI roll-up begins with margin improvement driven by a technology platform.

If this lever isn’t available, it isn’t a venture roll-up at all—it’s a standard PE or search fund strategy. Historically, deploying margin-expansion playbooks required sizable teams, heavy operational investment, and the patience that private equity is built to deliver.

AI is now rewriting this constraint. Workflow automation can replace large portions of back-office labor. Shared infrastructure reduces SG&A. Integration that once required armies of operators can be achieved with lean teams. The cost barrier that kept sophisticated operational playbooks out of the hands of venture investors is eroding.

Without this shift, the rest of the model doesn’t work.

In the case of Jutro, over the last year they have completed nine acquisitions. Jutro has automated large portions of intake, documentation, and administrative workflows using AI agents embedded directly into its proprietary EHR. This allows doctors to focus on clinical decisions while materially reducing per-visit operational cost. As Jan Szumuda, of WEG explained: ““Jutro Medical nearly quadrupled its revenue year over year while keeping EBITDA around break-even – a rare combination in this market.” Largely driven by this playbook.

A Market Full of Under-Optimized Assets

Across markets, particularly in tech-enabled services and digital infrastructure, there is a long tail of subscale businesses with recognizable brands, sticky customer relationships, and recurring revenue.

Many were built by entrepreneurs who were not building for venture-sized outcomes. These are traditional businesses. Their products are fine (and often excellent at small scale), but many parts of their business, like pricing and operations are under-optimized.

As a result, they tend to have low EBITDA margins and slow growth. And in today’s market, low valuations for traditional assets create additional leverage: buyers can acquire durable revenue for less than 1× ARR. These are often profitable businesses. Net of leverage, it may not even take much equity.

In Europe, for Jutro’s example, there are over 100,000 small clinics, many of which will go through generational transfer over the next decade. Primary care spend exceeds Eur200 billion annually in Europe (EUR 9 billion in Poland alone) yet, as Jutro explains it: “many clinics still rely on manual, paper-based processes that slow access to care and strain an already limited capacity”.

Acquisitions as a Growth Hack (Sometimes)

Traditionally, acquiring revenue was more expensive and more complex than building it. AI roll-ups are a tool to hack growth.

Buy revenue for less than low ARR multiples (ideally <1.5x)

In today’s environment, founders can purchase distribution, customers, and cash flow for a fraction of replacement cost. It is unprecedented in the venture cycle. Note that revenue is clearly not the end metric here, and ultimately it will be EBITDA or FCF. BUT, since the bet in AI roll-ups is a traditional business can be transformed into one with more software like gross margins, revenue multiples are easier comparable metric for the purposes of this blog.

Accelerate the growth arc

Each acquisition adds customers, cash flow, and data: the inputs that compound fastest when stitched together. If the acquirer has a growth playbook to scale faster all the better. What once required years of grinding for organic scale can now be achieved in a handful of transactions.

A strategic shortcut

Instead of expanding product breadth slowly, founders can assemble complementary offerings into a platform. Instead of fighting for distribution, they can buy it. Some of the best roll-up plays figure out ways to cross-pollinate customers across offerings, increasing LTV, and further improving unit economics.

Jutro is among the first operators in Europe to apply an AI-enabled roll-up strategy in healthcare. The company acquires small primary care practices and rapidly integrates them onto a unified platform, standardizing workflows, quality of care, and economics across locations. Jutro is accelerating its acquisition pace from 9 over the last year to 20 annually going forward.

The Four Levers of Venture-Scale Roll-Ups

When they work, venture roll-ups can drive three simultaneous levers of value creation, and sometimes a fourth.

1. Grow the Top Line

Venture teams bring product velocity, brand building, and go-to-market sophistication to subscale assets. Often targets have not built customer acquisition playbooks. Taking best in class startup approaches and applying it to the chosen category can unlock meaningful growth.

2. Automate the Back End

AI and shared systems standardize processes and reduce the operational burden. SG&A falls. Margins expand. Integration becomes repeatable. As noted above, this is what separates AI roll-ups from other platforms.

3. Cross-Sell and Integrate

Every acquired asset widens the platform to sell other products within the family or ecosystem.

4. Align incentives

Retaining key talent is often key in roll-ups. A fourth lever we are interested in at Fluent is employee ownership. Companies like Teamshares (announcing they will go public via SPAC next year) have demonstrated that many business owners are looking for alternatives to selling to traditional buyers, and empowering their employees. They often transact at similar or lower prices PE would offer. Employee ownership can be both a competitive advantage to the platforms for close rate and pricing.

Alex Barrett and Yoni Rechtman frame it nicely as an entirely different vector for impact.

Ultimately, combining some or all of these levers helps the flywheel begin: more acquisitions → more data and revenue → better automation → higher EBITDA. When executed well, these systems can expand EBITDA 3–5× within a few years on existing assets.

Where Venture Roll-Ups Fail

Most roll-ups fail, often for predictable reasons.

First, while ever deal looks to prove margin expansion, the goal posts of scaling the business with venture capital change over time (like they do in any preseed startup evolving to Series A). The first few deals are to show operational improvement. Over time, companies need to demonstrate repeatable deal making and integration processes.

Second, venture roll-ups work today in certain industries where competition is limited. If many competitors get funded in the same category (which we’re increasingly seeing in the U.S. in certain “hot” categories (looking at you HVAC), the alpha will disappear. This happened to the Amazon aggregators a few years ago.

Third, alignment with investors and the acquired teams need to be managed. This model requires patience, price discipline, and clear incentives across founders, investors, and operators. If investors push for aggressive valuations or misaligned off-ramps, the strategy can break. The employees of the acquisition need to be aligned – from the founders (if they stay on) to the full team. The best operators design against these risks from day one.

Why we backed Jutro?

At Fluent Ventures, we focus on geographic arbitrage: backing teams that execute proven global models in markets where structural conditions create an asymmetric advantage. Jutro fits this strategy precisely.

While primary care roll-ups in the U.S. have been constrained by high labor costs and high multiples, markets like Poland combine publicly funded healthcare, extreme practice fragmentation, and an aging physician base. This creates a compelling opportunity for consolidation — if integration costs can be dramatically reduced.

What differentiated Jutro was its order of operations. The team built a proprietary EHR and operational stack first, then layered AI directly into live clinical workflows before scaling acquisitions. This makes integration faster, quality more consistent, and margin expansion real from day one.

We also believe Europe is under-appreciated as a market for AI-enabled services businesses. Labor constraints are more acute, digitization lags the U.S., and competitive intensity remains low. Jutro operates at the intersection of these dynamics, applying an AI-first playbook in a region where the ROI on automation is structurally higher.

Why This Window Exists Now

The opportunity is not structural; it is temporal. Several forces have converged at once.

We have written about generational transfer. Millions of profitable, founder-run SMBs will change hands this decade. Many of these owners want scaled successors, not just financial buyers.

How technology will power generational transfer from the coming silver tsunami of small business ownership

The Silver Tsunami – referring to the demographic baby boomer generation that is retiring, aging and dying - was coined nearly two decades ago. Originally, it highlighted the looming healthcare crisis.

A roll-up strategy benefits from much lower transactional and integration costs with a shared customizable platform. What took PE firms a decade—process standardization, system integration, workflow redesign—can now be done in months.

There is also a honeypot of capital: There are numerous large VC funds who have allocated big portions of their funds (or raised dedicated vehicles) to fund the venture AI roll-up space. A new category of players will have access to play here

Conclusion: The Emerging Playbook

AI is redrawing the boundary between PE and venture. Roll-ups—previously too operationally heavy for venture timelines—now sit on the frontier of what is possible. The opportunity is narrow and demands precision. But the teams that get it right may define a new generation of venture-backed winners: durable, cash-generative platforms built through the marriage of technology, integration, and disciplined acquisition.

A new playbook is forming. And it is arriving just in time for the next era of innovation investing.

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)