LatAM's rise, the Camel Context, GenAI Hype and more

The future of innovation is global. We discuss it here.

Latin America As The Engine Of The World

Atlantico’s excellent report on the state of technology in Latin America just dropped. I’ve long been a believer in the region’s potential, and wanted to take this opportunity to highlight a few salient takeaways.

We all know the headlines: the market is massive. If it were one country it would be the #3 economy in the world.

Underlying this enviable market size are a number of strong tailwinds: it has a young population, strong growth and and many governments have invested in digital infrastructure (e.g. Brazil’s implementation of real time payments like PIX). Internet penetration skyrocketed in many key markets: In Mexico from 40% to 77% and in Chile from 55% to 90% between 2012 and 2022. More tellingly, internet engagement is high: Latam is among the highest users of Instagram, Facebook and other internet properties. Payment networks in Latam have dramatically increased via digital channels, growing nearly 20% in the last 5 years.

Yet, the same high-flying GenAI startups from Silicon Valley may not be solving the real needs that resonate with real customers on the ground. Unemployment is high in many markets, for instance reaching from 11% in Colombia or 8% in Chile. Many parts of the labor market remain informal, and achieving the majority in Mexico and Colombia. That’s why the biggest pain points have been and continue to be in financial inclusion, healthcare, and supply chains.

In Out-Innovate I wrote the best global entrepreneurs were Creators, not Disruptors, building industries that touch the mass market with real needs. This is truer today than ever.

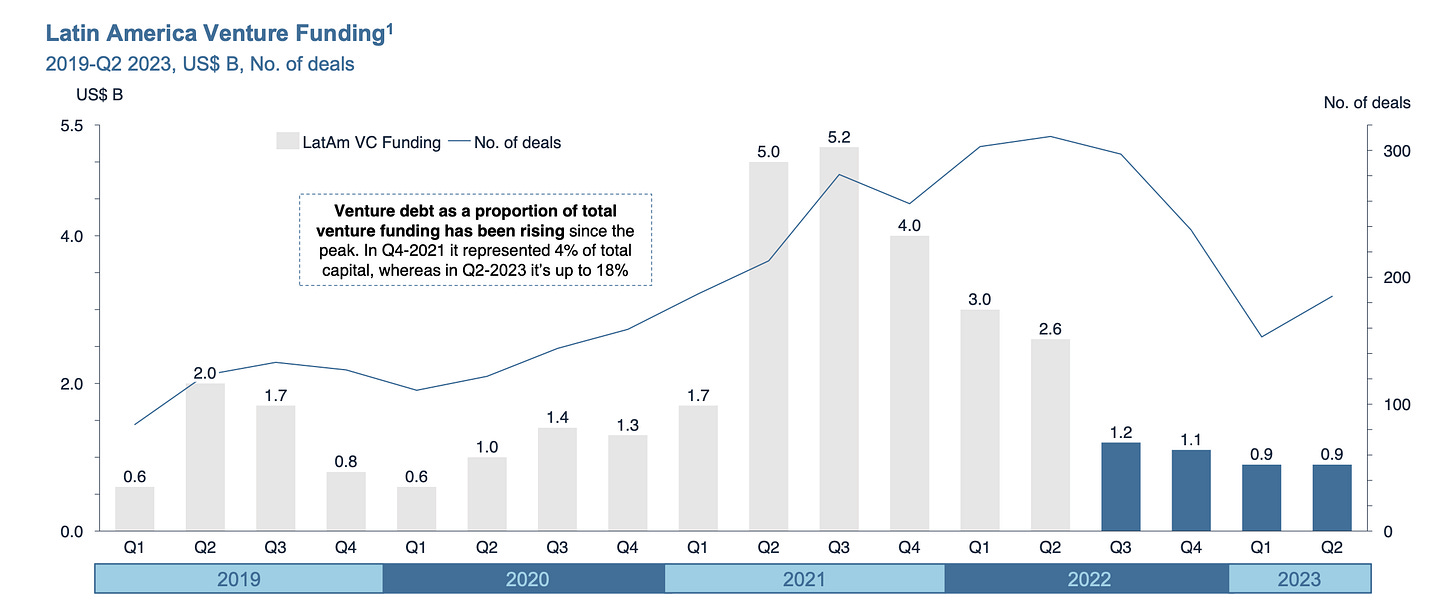

As the tech market retrenches, nowhere is the pain felt harder than in emerging markets. Latam for instance saw all progress in VC funding of the last few years disappear.

Yet despite this, enthusiasm and optimism is high, and the prize remains massive, as evidence with multiple sentiment surveys.

In the next decade, I expect we’ll see a number of scaled companies go public or sell (so far the largest M&A deal of the year anywhere was in Latam) which will demonstrate the venture potential of the region, continue creating entrepreneurial mafias and arm the next generation with capital and skills to scale businesses.

I think we’re still just getting started. Read more here.

The Camel Context

Many startups raised at exorbitant valuations, often far beyond where their traction would merit. Now, and particularly at the growth stage, many rounds have been hard to get done. The bid ask spread can be too wide, or the underlying business is still too nascent or loss making for deals to consummate. This is still playing out in the markets.

If anything but free cash flow is an abstraction of business health - from profits, to EBIT, to EBITDA, gross profit, then revenue, GMV and user growth are the widest abstractions and valuation metrics - thank you 2000era tech for offering valuation per eyeballs, WeWork for community adjusted ebitda and certain crypto currencies who argued that revenue didn’t matter but instead their future taxation base via transactions. At minimum we’ll need to focus only on revenue. In the future I’ll write a piece about the metrics I think matter most.

Many founders have only operated in a single market context: the good times. But as times change how should founders adjust their mental models? Good thread.

Interesting discussions

“The notion of an ‘asymptote’ in mathematics serves as a fitting metaphor for the quest for artistic perfection. An asymptote is a line that a curve approaches but never actually reaches.” The algorithmic march toward aesthetic perfection leaves art devoid of its soul. A new study shows our bias against flawless AI art, favoring works with a perceived human touch. For in the wrinkles and cracks lives meaning; in the subtle notes of discord, profundity. As AI pushes boundaries, we must hold fast to creativity's irreplaceable human element. Not in achieving perfection, but in capturing life's imperfect nuance, does art find purpose. Embrace your imperfection.

It is always interesting to read lists and see what inherently was prioritized or discounted. Enjoyed this one on the top 100 global impactful startups. Some I would have expected in, and others I learned quite a bit about.

Around the world, the unbanked are taking first steps into the digital economy. But migrating cash under the mattress to an abstract app requires confidence many don't yet have. Though mobile networks expand, digital know-how lags. To solve for these last-mile users, financial services need redesign - not just accessible, but valuable and equitable. This means plain language, not jargon; type shortcuts for varied literacy; and local human guides. It means built-in comprehension pauses, not dark patterns pushing unwise decisions. Thoughtful design can pave the path to financial literacy and confidence. With the right inclusive tools, the unbanked can gain prosperity once out of reach. For a billion at the margins, good design unlocks the digital economy. It turns first steps into confident strides.

In fintech I have argued that over time every startup will become competitive in a category. Interesting datapoint: Brex the corporate spend management launched a travel offering. And Mesh Payments launched general expense management. What’s next?

Is fail fast always the right answer? Interesting take that argues the failure versus success debate overlooks their shared capacity for knowledge. The challenge lies in processing experiences into actionable wisdom. This requires time and space - to reflect, document, and apply learnings. Rushing a "fail fast" approach often hinders growth. A structured approach allows a different process, and by creating the right conditions, we transform experiences into wisdom, turning reflections into progress. The path from insight to innovation requires patience, care and an unrestricted environment to grow.

When founders pitch, they can often choose to sell vision or traction. Which is appropriate. The answer depends on stage but it also requires storytelling on the opportunity.

What should business leaders to in the face of AI? “Technology bubbles can pose difficult quandaries for business leaders: They may feel pressure to invest early in an emerging technology to gain an advantage over competitors but don’t want to fall for empty hype. As we enter a period of greater economic uncertainty and layoffs in multiple industries, executives are grappling with questions about where to cut costs and where to invest more.” My view: don’t buy into the hype more broadly. Understand your business, and the specific applications AI can apply to, and invest in those.

How should you identify, test and prove your pitch assumptions? Fun collaborative article on many key elements of the journey.

Book of the month

This month I read Never Split the Difference by Chris Voss.

He upends much of what I’ve heard about negotiation best practice - or at least contextualizes it with the key emotional element. “I don't use the phrase "win-win" because most of the time whoever uses that phrase is either trying to cut your throat or is a horrible negotiator. But the reality is that in a relationship both sides have to gain. And negotiation can improve all of your relationships. The closer someone is to you, when they win, you win. When you negotiate a win for your spouse, you win.”

![[99%Tech]](https://substackcdn.com/image/fetch/$s_!Vpj7!,w_40,h_40,c_fill,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F288cd65c-980f-4acb-8182-1853ec1e444d_1280x1280.png)